Health insurance is one of the most competitive sectors online and you can easily see why. Search demand for health insurance products is high and everyone wants a piece of the pie. Here at Adido, we have experience working with health insurance providers and have seen the sector becoming more competitive over time. With this research, I wanted to see how the industry has grown over past three years following the pandemic and what it takes to rank organically for some of the most competitive terms in today’s marketplace.

This article is looking to answer the following questions.

- Has overall interest in health insurance products increased in the UK?

- Who are the winners in the online health insurance space?

- What has their online strategy been for the past few years following the pandemic?

- What does it take to rank organically in this space?

Has the interest in health insurance products increased?

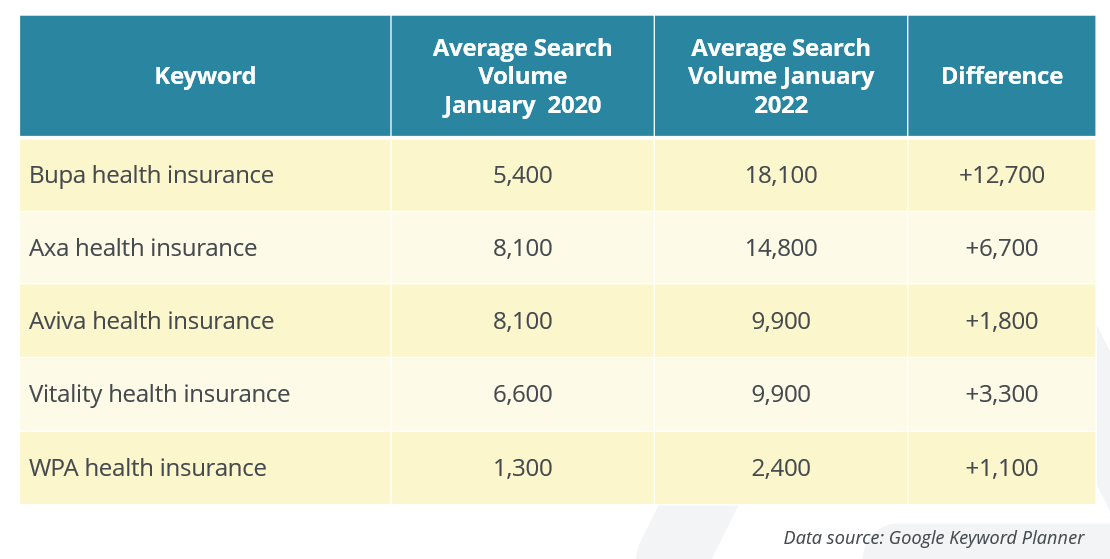

To begin with, I selected four main terms and have compared the keyword search volume just before the pandemic and three years after. There hasn’t been a change in search volume for the main ‘health insurance’ term but a growth in interest can be clearly seen for the remaining keywords.

This may not come as a surprise to you. A nationwide study by Consumer Intelligence showed that the percentage of people considering buying health insurance online jumped from 15% before the pandemic, to 27% post-COVID-19 with younger people being more likely to consider private healthcare or private insurance.

These initial numbers are great, but I wasn’t convinced so I looked at the search volume for the top health insurance providers in the industry and we can see a considerable jump in searches for ‘bupa health insurance’. This is a 235% jump in search volume for just that one provider.

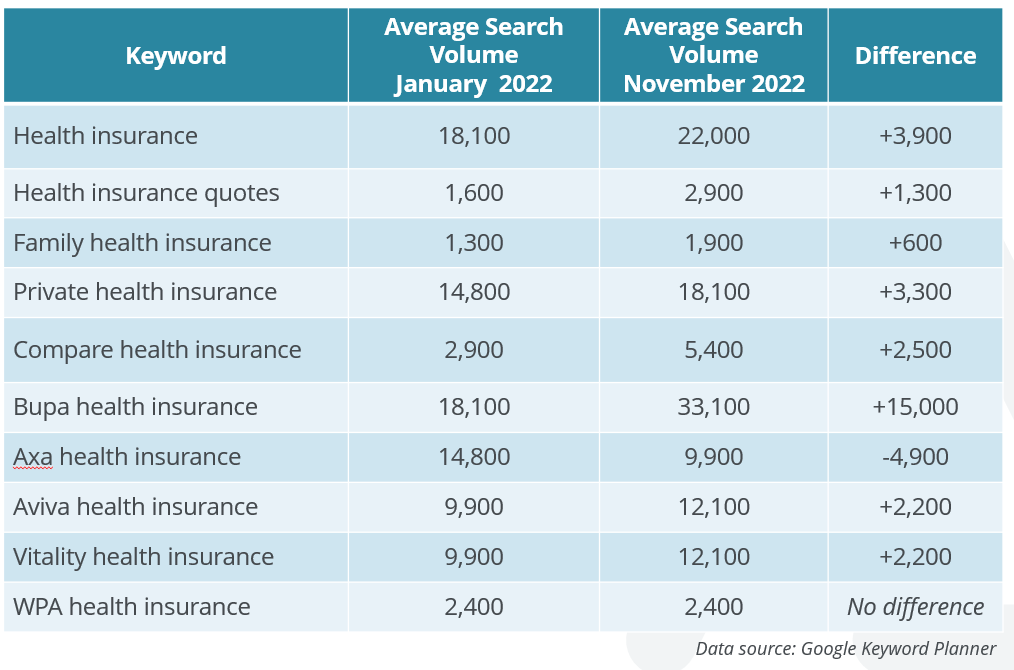

It is clear to see that demand in health insurance products has grown over the past three years, however the UK and the world are experiencing a cost of living crisis and a reasonable assumption can be made that there might be less interest in health insurance policies in recent months. The data is showing the opposite. Compared to earlier in January, the terms used for this evaluation have seen an increase with the exception of ‘Axa health insurance’.

It is important to note that we are seeing an increase in interest in health insurance products but we cannot see conversion data.

Now that we know interest continues to go up, let’s look into who is winning the race to the top of the organic SERPs.

Who are the top performing sites in the online health insurance sector?

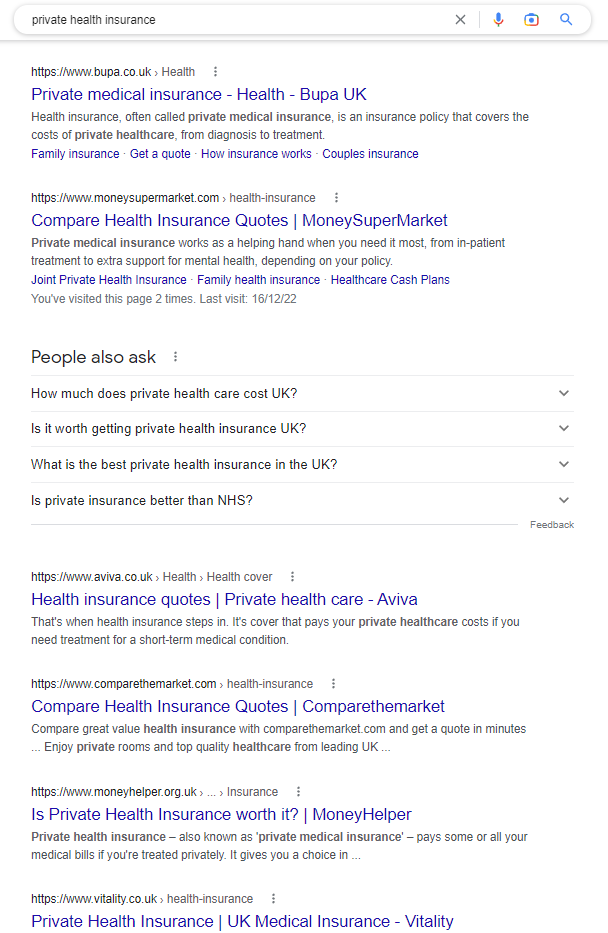

In the SEO world, you will most likely hear that your online competitors will be different than your real life competitors. This is because the sites that are outranking you for the terms you want to be found for are the sites you are competing against for ranking positions in the SERPs. For example, as an insurance broker you might not perceive MoneySavingExpert to be a competitor, but if they are ranking on page one for the term ‘private health insurance’, they will be seen as one.

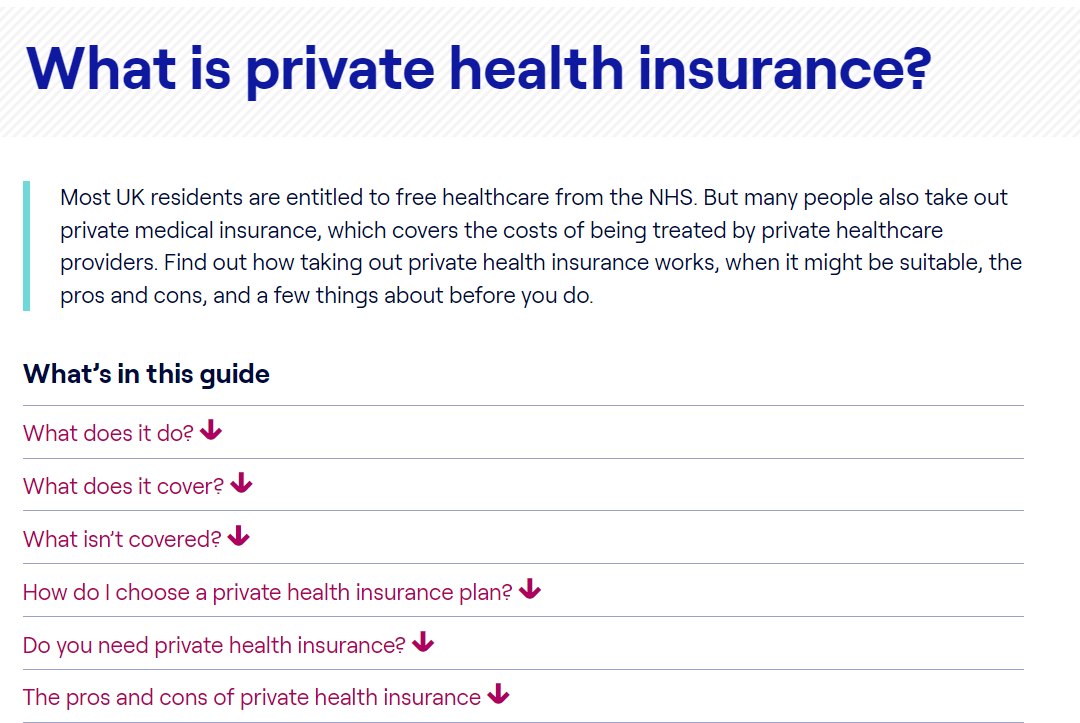

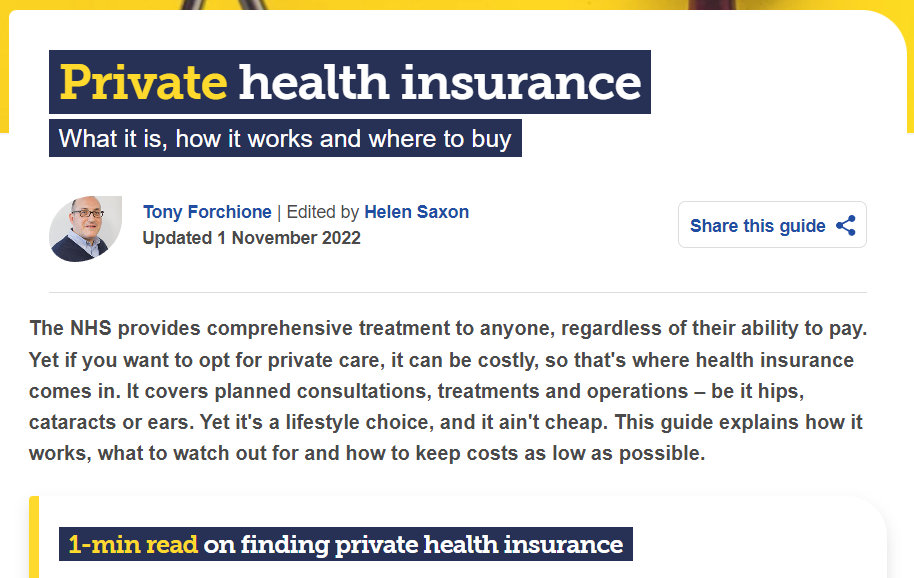

In order to see who are the top performing sites, let’s start by analysing the SERP for the keyword ‘private health insurance’. What we can see straight away is that different types of companies are ranking on page one. Bupa Health, Aviva and Vitality are health insurance providers, whilst MoneySuperMarket is a broker and Money Helper is an informational website providing advice on health insurance products.

What the SERP can also tell us, is that Google is presenting a PAA (People also ask) box with questions related to ‘health insurance in the UK’, suggesting that not only commercial content is important, but helpful advice is also needed for people who need additional information on the topic.

From our own experience and continued testing, we can conclude that in the online health insurance space, there are 3 main different types of organisations ranking in Google.

- Health insurance providers - Bupa Health, Aviva, Axa Health

- Health insurance brokers - Money Super Market, Go Compare, USwicth, Confused

- Third party comparison and informational sites - MoneySavingExpert, MoneyExpert

Health insurance providers

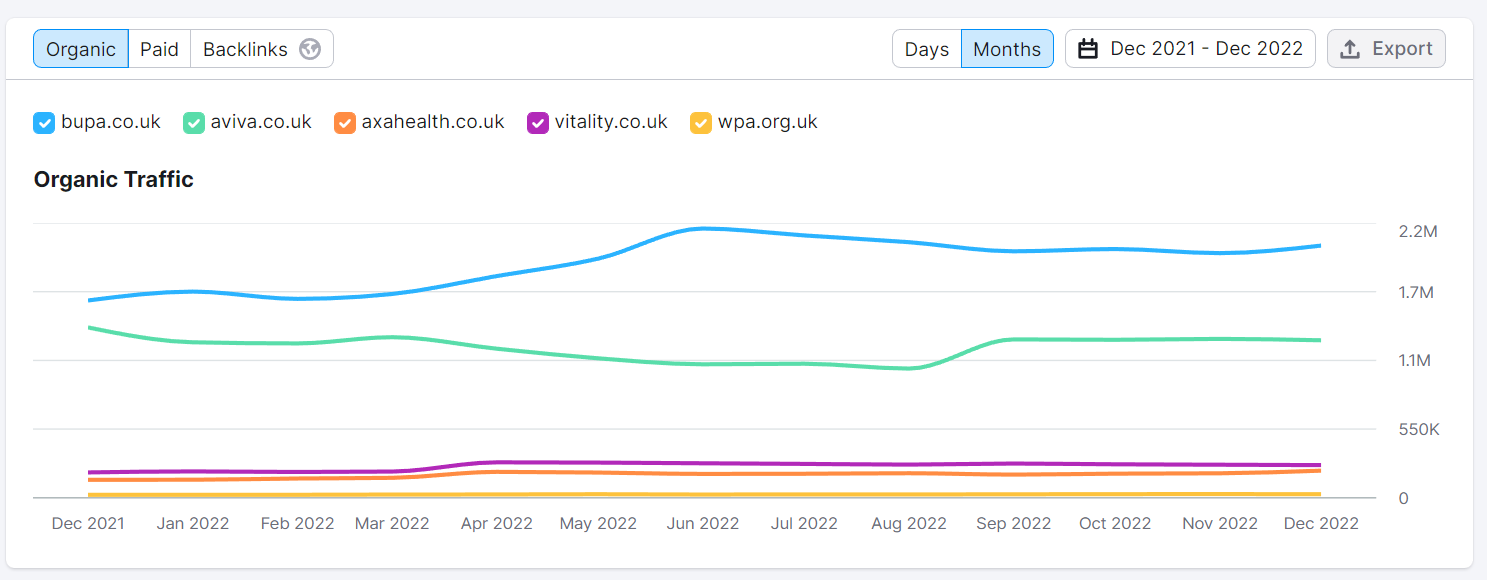

Within this category, we have looked at the organic rankings for Bupa Health, Aviva, Axa Health, Vitality and WPA. These top sites rank for hundreds of keywords, have thousands of backlinks and it’s clear that they have been investing in their organic presence for years. Additionally, they have media budgets that go beyond search engine optimisation - they are running TV advertising and paid advertising which increases their exposure and brand awareness.

Out of the five sites, Bupa Health is winning the traffic race, followed by Aviva and Axa Health. I must caveat this data because the individual brands will have different brand keywords for which they are ranking and this will impact the data you see in the below graph.

With over 33k searches for the ‘bupa health insurance’ term, however we slice the cake, Bupa Health is dominating the health insurance sector online.

Health insurance brokers

The search intent behind the keyword 'compare health insurance’ is clear. The user wants to see and compare health insurance quotes from different providers. What this tells us is that, for this particular term it will be almost impossible to rank a page from an individual health insurance provider.

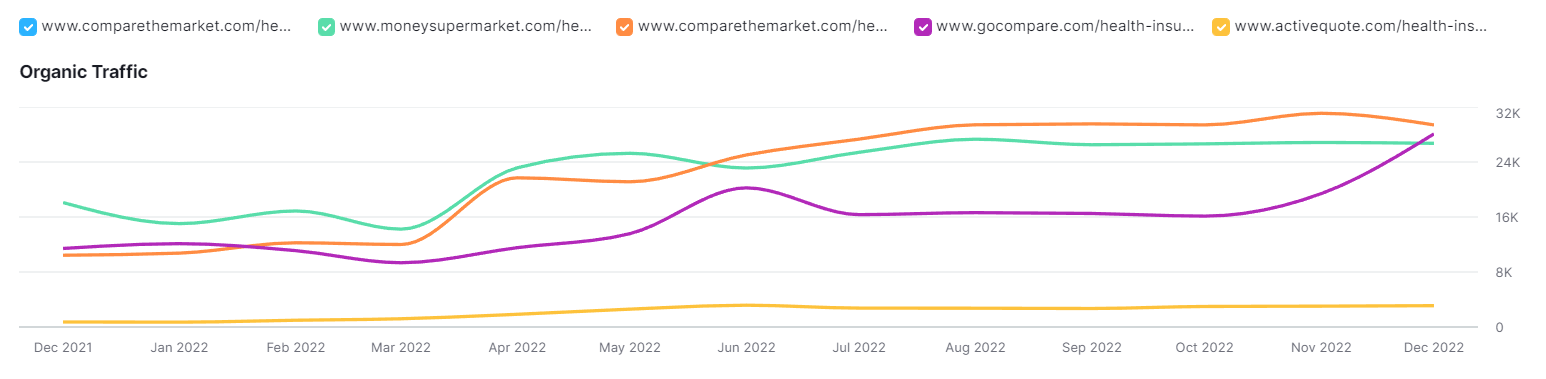

For this analysis, I have looked at the top ranking sites for the keyword ‘compare health insurance’ - Compare The Market, Go Compare, MoneySupermarket, Confused, and Active Quote. These websites offer other types of insurance policies as well, which is why I have focused purely on their ‘Health Insurance’ subfolders.

Compare the Market and MoneySupermarket are dominating the organic SERPs, followed by Go Compare and Confused.

The CompareTheMarket health insurance subfolder alone is ranking for 1,200 keywords with 478 keywords ranking on page one. This is a tough act to follow, especially if you are working with a health insurance broker who is just starting to invest in their organic presence.

Third party websites

The third type of health insurance online competitor you will face are third party advice sites that do not offer health insurance policies but hold a lot of authority in the field. Pages like these rank for over 1,000 informational and commercial keywords. These sites are trusted sources of information and it won’t be an overnight task to outrank them for the terms they have spent years working on.

This type of content found on Money Helper or MoneySavingExpert is regularly updated, has authors, detailed information, internal links, FAQs, and backlinks, all coming together and creating a great level of trust and expertise.

Has the health insurance online space become more competitive following the pandemic?

We know the health insurance sector has always been competitive online, but has it become harder to rank online over the past three years? In any competitor analysis, it is not only important to understand whether your online rivals apply a different strategy than you, but also at what rate they are creating content or gaining backlinks.

Let’s look at a few examples.

Bupa Health

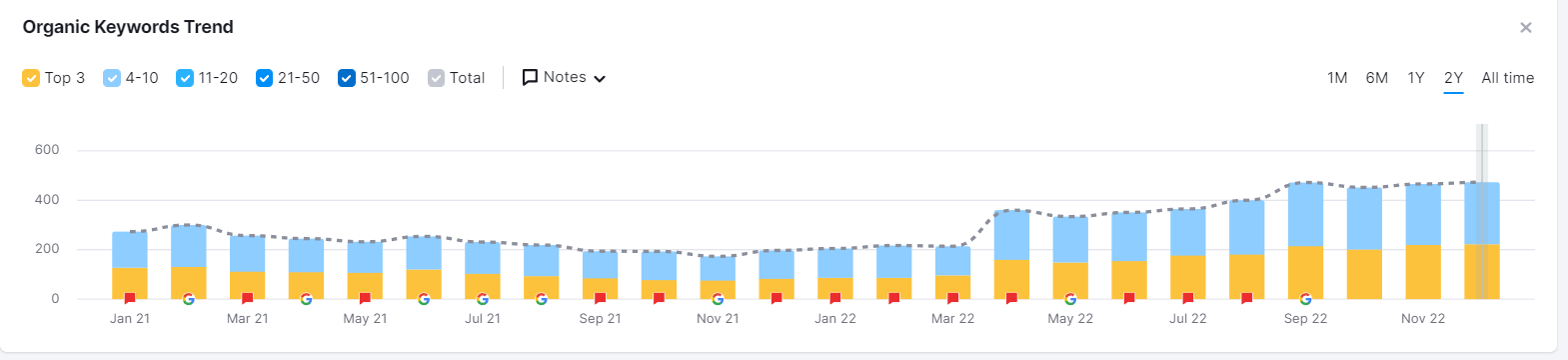

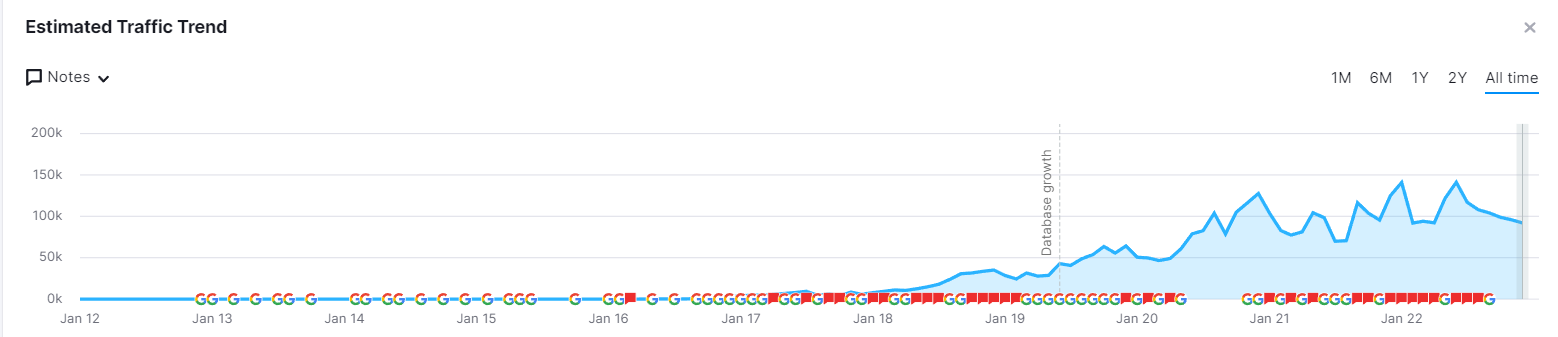

Overall Bupa Health rankings in the UK began seeing an increase after 2020. In fact, according to Semrush data, they have seen a 62% increase in the number of keywords they are ranking for between January 2020 and December 2022. How did they achieve this?

We can see that the brand has invested heavily in their organic informational content as they have produced over 480 wellbeing articles in the past three years. These additional articles have provided them with page one rankings for over 3,500 keywords, 255 of which are ranking on position one.

This shows continuous investment in their content strategy, making it harder for newcomers to the industry to quickly gain rankings and see results. What this also shows is that regardless of how well-known the brand is, there is a clear goal to continue to improve and grow their online presence. The wellbeing content is not only increasing their brand awareness but also the authority and the experience in the field of Health.

This is a snapshot of the rankings for that subfolder and you can clearly see the growth they have achieved in the past couple of years. This is not a small undertaking, especially when this is not the only area of the site that has seen an improvement.

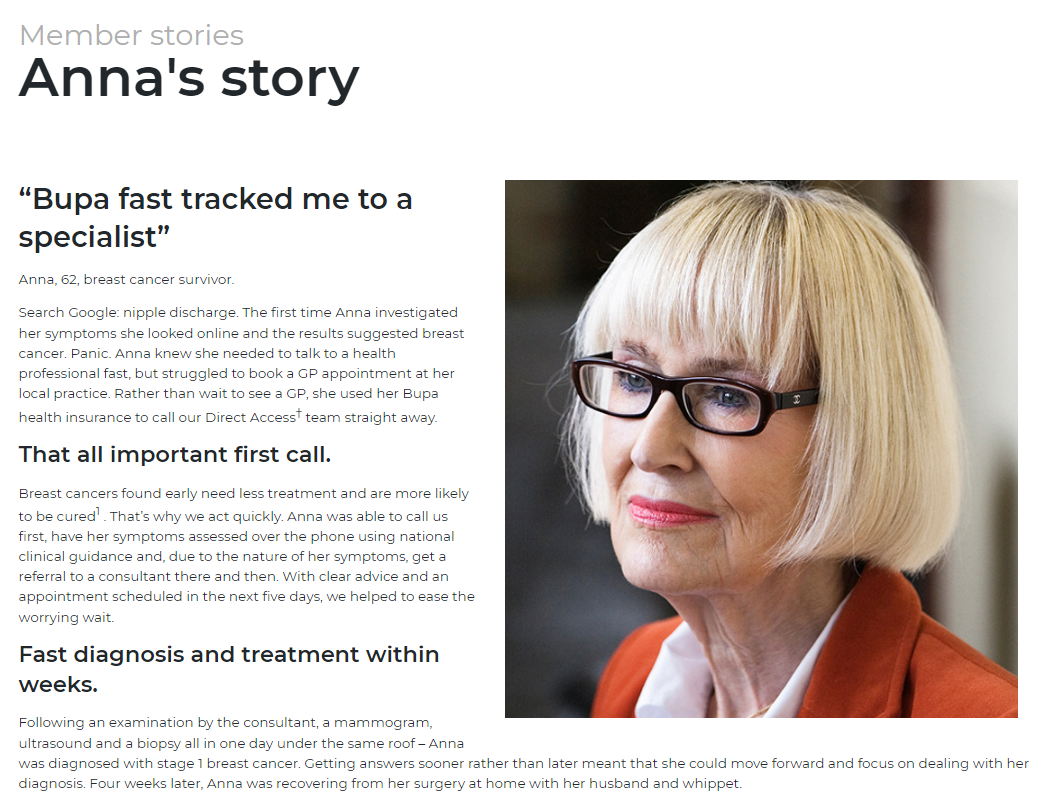

What we can also deduce based on their sitemap changes is that they have created member stories, providing real case examples of how their product has helped people. This is a great example of content that supports the E-E-A-T metrics introduced by Google initially in 2015 and recently updated to include Experience.

In the same period of time Bupa Health have also steadily increased the number of referring domains to their site. Whilst there have been talks about links being less valuable in the future compared to on-page website factors, links from relevant publications are still important for organic ranking.

AXA Health

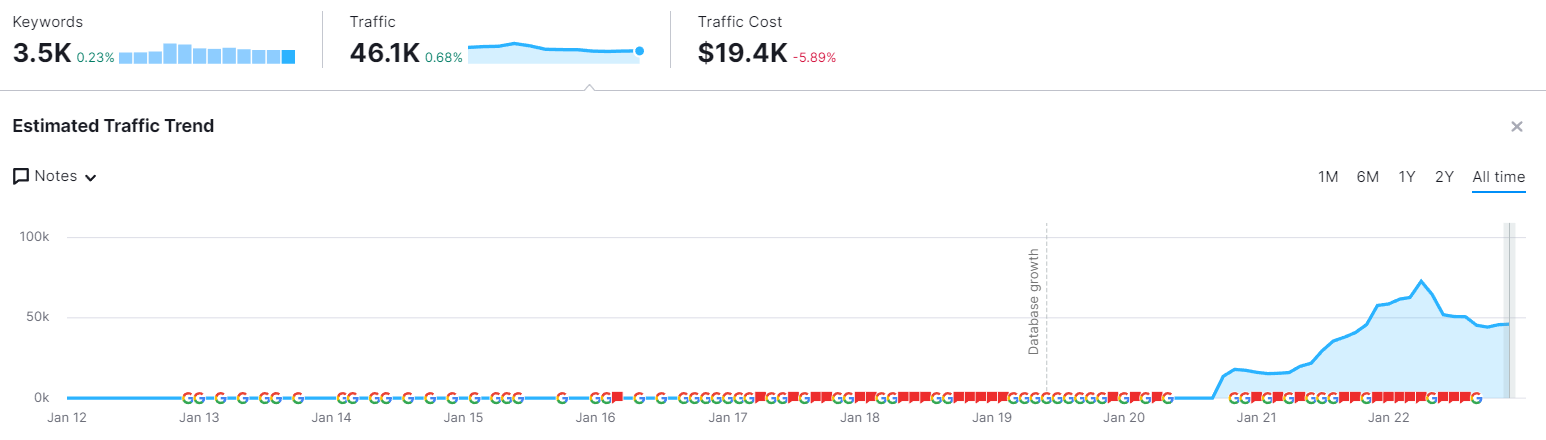

Similar to Bupa Health, Axa Health have invested in their health and wellbeing content and have grown their page one rankings for 3,500 keywords over the past couple of years.

In fact, these top five health insurance providers have considerably grown their organic presence and the number of keywords their sites are found for. Of course, we need to appreciate that these companies also offer other types of insurance policies and not all keywords will be relevant to ‘health insurance’.

However, what I am trying to show here is that even the biggest brands in the industry are investing in their organic strategy and are continuously building their content and increasing brand awareness. If they are, so should you.

What does it all mean for the health insurance space online?

It means that it is more competitive to rank for health insurance terms today, than it was 3 years ago. Companies operating in this space are constantly improving their online presence by creating more content, and increasing their brand awareness. What it took to rank organically a couple of years ago, may not be enough to rank today.

Enough about the Goliaths of this industry. Let’s talk about our Davids.

What about the Davids of the online health insurance sector?

It’s not realistic to think that every company will have the SEO budgets of Bupa Health, Axa, Aviva, or even Vitality Insurance. This is why it is so important to understand where the opportunity is and to be candid with yourself and able to prioritise opportunities and first focus on the ones that bring commercial success. Rankings and traffic are great and it is indeed what SEO strives for, but it always needs to relate to a commercial element.

Adido has been working with a health insurance provider for the past two years and I am happy to share that their organic performance has grown from strength to strength. As part of our online strategy, we focused on technical excellence, creating content and optimising pages for the right search intent, looking for niche terms that have not been covered by competitors.

As a result, we have seen a continued improvement in rankings, traffic and conversions from the content created by the Adido SEO team.

What does it take to rank in the health insurance sector?

Health insurance websites fall into the YMYL (Your Money Your Life) category which means that they need an exceptional level of E-E-A-T signals on the site. This means that through different types of content, the site needs to be able to communicate their level of experience, expertise, authoritativeness and trust.

To be able to compete in the online health insurance space today, you will need to audit your website’s:

- Technical health

- Core Web Vitals

- Signals of E-E-A-T

- Existing Content

- Keyword coverage

- Content strategy

- Structured data

- Internal links

- Backlinks

- Local SEO

Final takeaways

The online health insurance space is an exciting but competitive market and it's important to understand that any SEO investment should be considered for the long-term. Focusing on getting the fundamentals right and finding a niche from where you can begin building your reputation and business will be key to succeeding in this highly competitive industry.

If you would like to discuss your organic strategy with our SEO professionals and see how SEO can help your insurance business, get in touch with the Adido team and see how we can help!

Related articles:

The importance of SEO in web design and web development

What is the Google Helpful Content update and what does it mean for your site