With the busiest part of the year in travel 'peaks' coming to an end, how well did online sales do compared to previous years?

Peaks, Turn of Year, Wave... the busiest time for holiday bookings has a number of different names depending on the travel niche you find yourself in. But whatever you call it, the period from Christmas until the end of January (some say February) is a busy season for travel. Families getting together, couples planning a romantic getaway or solo travellers yearning to scratch that wanderlust itch... nearly everyone is looking for, and increasingly booking, travels away in 2023.

With so much riding on this time of the year, it's important for the travel industry as a whole to spot encouraging signs in the first few weeks of the year in order to build confidence to invest throughout the year and beyond, along with planning capacity and also future marketing campaigns and plans.

How does 2023 look for online sales compared to previous years? Time to take a closer look!

Online travel sales in peaks/ToY 2023

I wrote last week about the positive signs on Sunshine Saturday in 2023 and how these signs looked positive for travel brands online for the year ahead. The good news is that the trend we saw there is replicated over a long period across peaks/turn of the year. For our research, we looked at a variety of travel clients across a number of niches to give a wide view of overall trends. We took data from the 26th December each year until 22nd January which totals 27 days, albeit with a mix of weekends involved in each timescale to perhaps slightly blur the data (we've got to draw a line somewhere!).

The general trends across all data is that visits, sales and revenue are all up against 2022, however they are still down in most areas compared to 2019/2020. This is also reported in Travel Gossip, with many of their partners reporting 'best year ever' holiday peaks sales, which is brilliant! Getting to a base line is tricky as each client has taken a different approach to their digital marketing each year - some invested heavily in peaks 2019/20, whilst others didn't, and the same is true in 2022/23. This means just looking at pure totals alone can often be misleading. In some instances we've looked solely at organic and direct traffic to try and reduce the 'noise' of other channels like Pay Per Click or display marketing which can drive a lot of traffic but result in few sales.

Peaks ecommerce revenue in 2023

We're a commercial digital agency. This means we focus on the revenue and profit for our (travel) clients more than general traffic stats. Whilst we can't dig into profit too much in our analysis here (each travel business has different costs obviously) we CAN report on revenue.

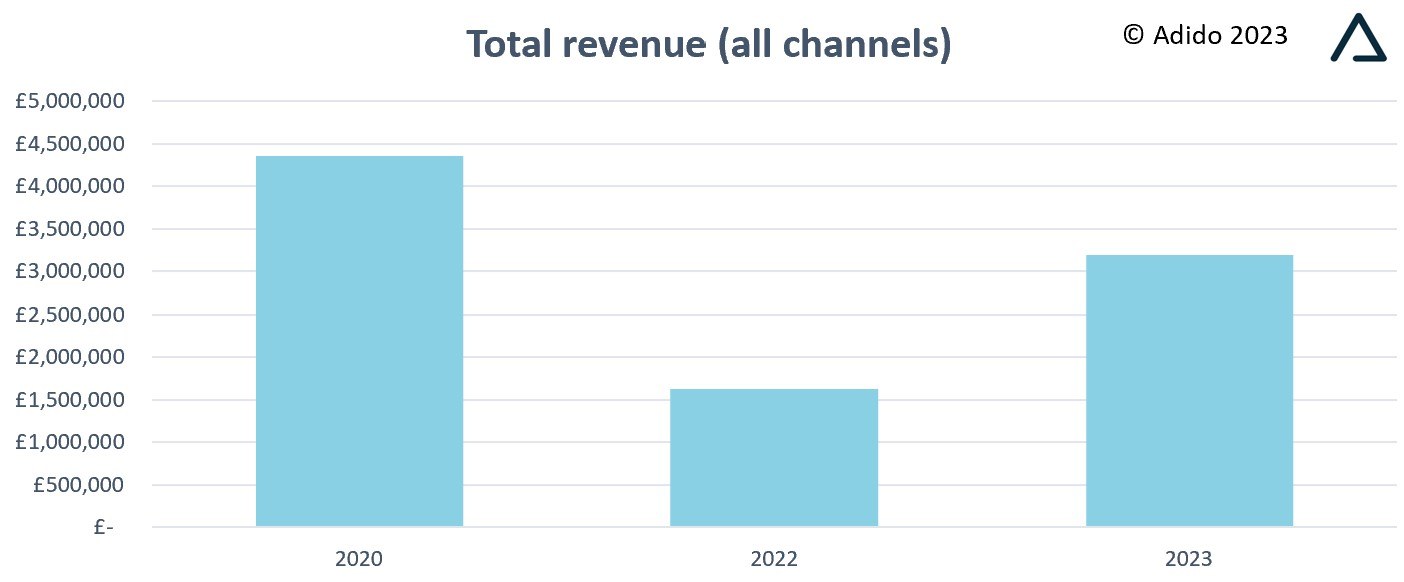

2023 looks like it is having a decent start to the year. Total revenue is up on 2022 significantly, with an increase of 49% YoY. With that said, total revenue is still down 27% compared to the heights of 2019/20. Whilst the numbers are moving in the right direction, there still appears to be some way to go before we get 'back to normal'.

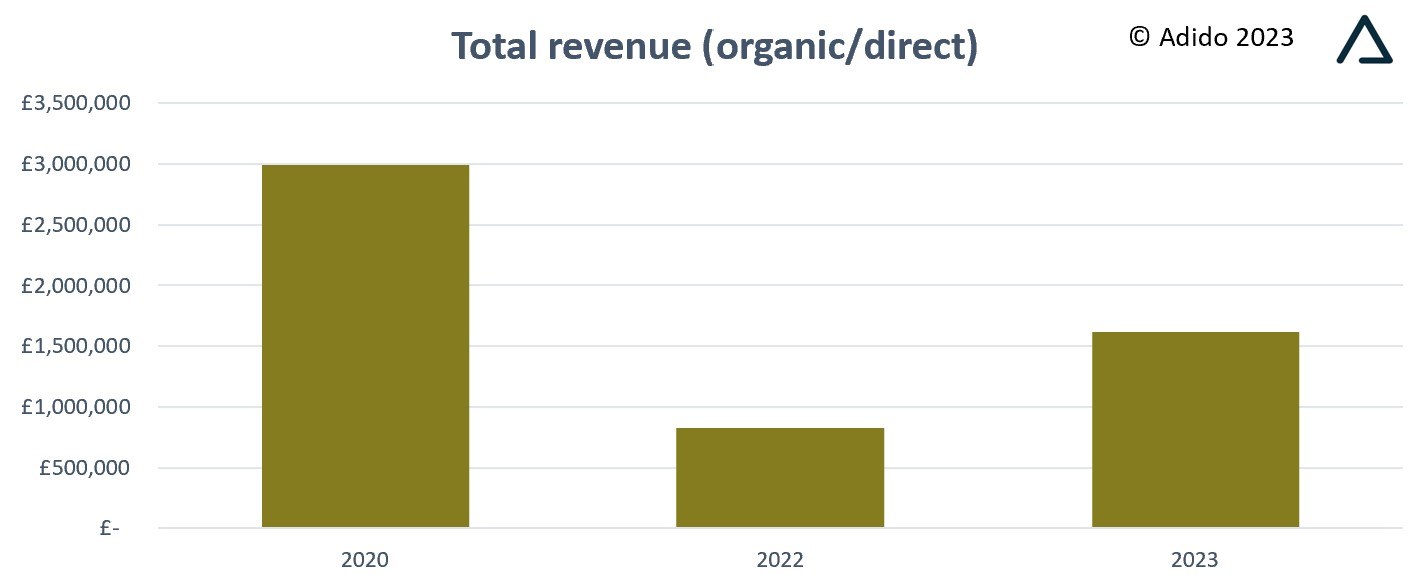

With some clients spending more, and others spending less, in digital marketing over the comparative dates, what happens if we look at revenue from just 'brand' traffic? We will assume here that direct and organic are nearly all brand-driven although some travel businesses are better at SEO than others, and this might add back in some noise, albeit again, hopefully like for like.

Here, the picture is a little less rosy, with sales in 2023 down nearly 50% compared to 2020, which is nearly double the effect that we've seen in total.

So what?

This would indicate that loyalty is on the decline with less customers coming back to places they know already, and instead shopping around. It could also mean that Google is doing a better job at pushing down organic listings while pushing more brand PPC ads, and therefore reducing overall organic traffic. Whenever there is change, there should always be analysis, and each client has their own reasons for increases and decreases which will be relevant to them (I'm sure you, dear reader, have seen many things affecting your travel sales and traffic!).

Average holiday booking values in 2023

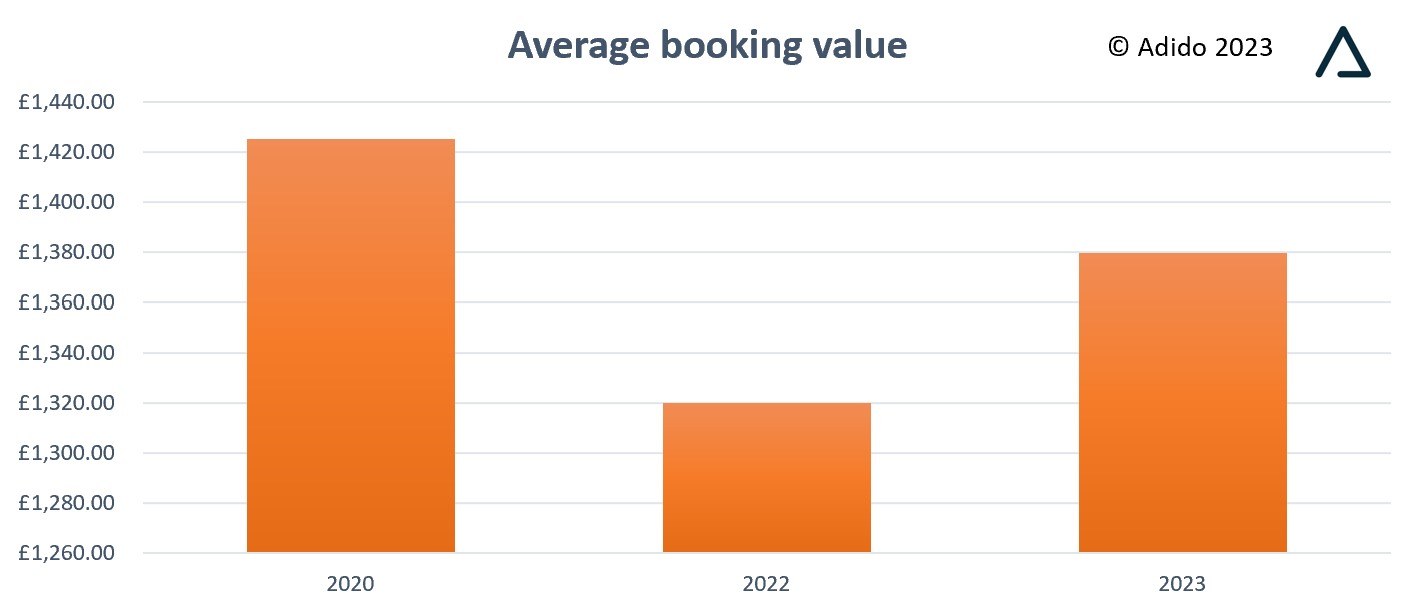

When it comes to average booking values, again we see a similar pattern with totals being down on 2020 overall but up on 2022, although the difference this time is much smaller with holiday booking values only being down a few percent. Realistically, despite the chunks of the chart, booking values are pretty consistent, however as mentioned in another blog, with inflation running at 10%, we could say that actually things are down YoY.

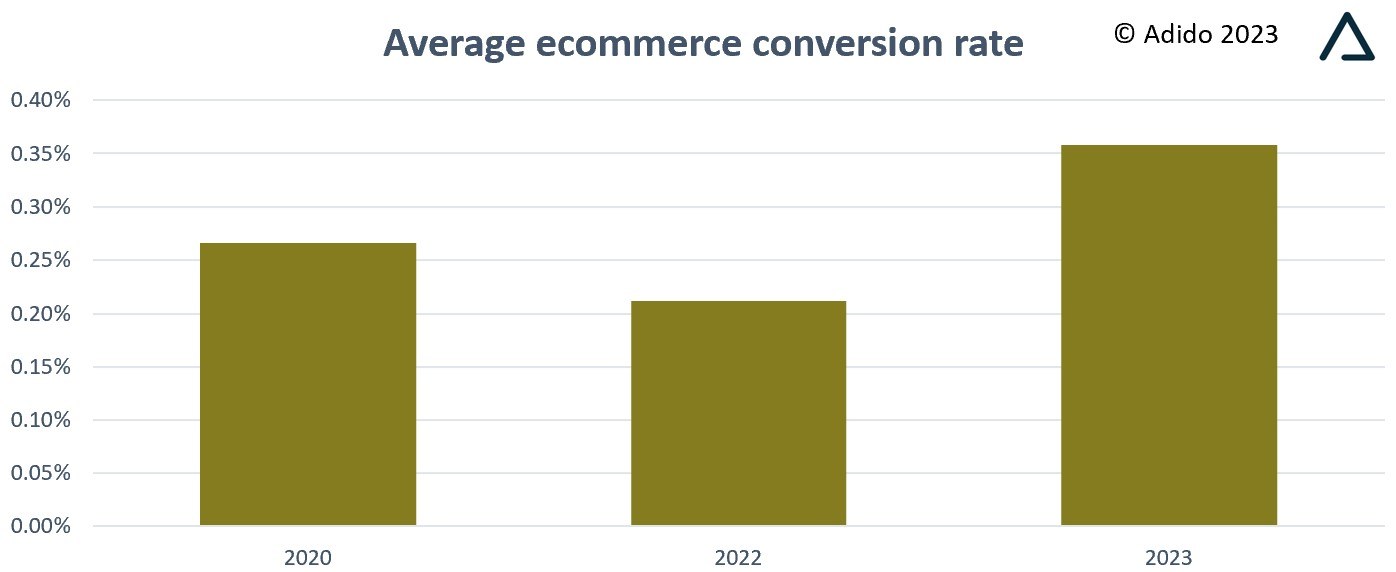

Perhaps the best news of all from the data we analysed is conversion rates across all data have improved more than any other measure. Conversion rates in total across all channels increased nicely, jumping up by over 60% compared to 2022.

This would indicate that those in the market are keen to book now which is great to see, albeit if you're using this data to plan ahead, perhaps treat it with an element of caution as the peak (clue's in the name I guess) has perhaps passed. We've heard from some in the travel industry that booking rates continue to be strong, so let's hope it carries on!

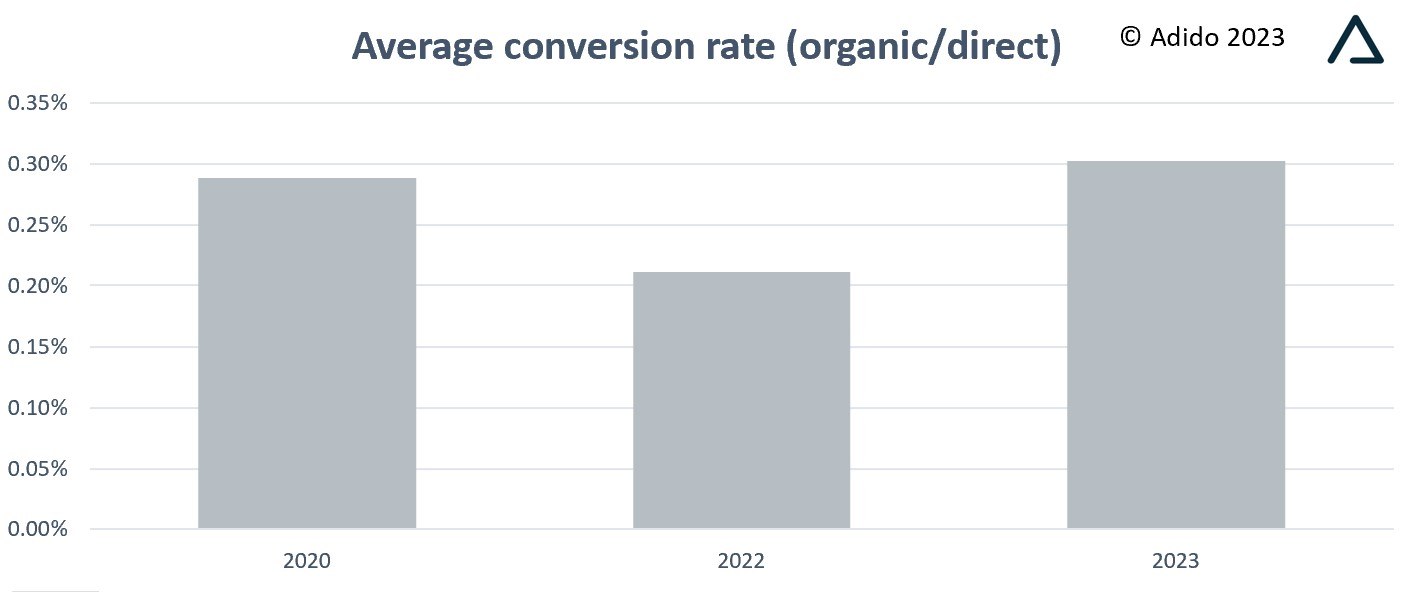

Taking out marketing media spend and just looking at organic and direct traffic again, we see a slightly different story with conversion rates looking a little flatter, and on par with 2020.

Again, so what? This tends to indicate that those who do know the brands they are looking for, this year at least, perhaps seem a little more likely to buy than previous years. With that said, surprisingly, overall conversion rate dropped with just 'brand' searches, suggesting that travellers are perhaps keen to book with new brands, if the travel offering and online experience is right.

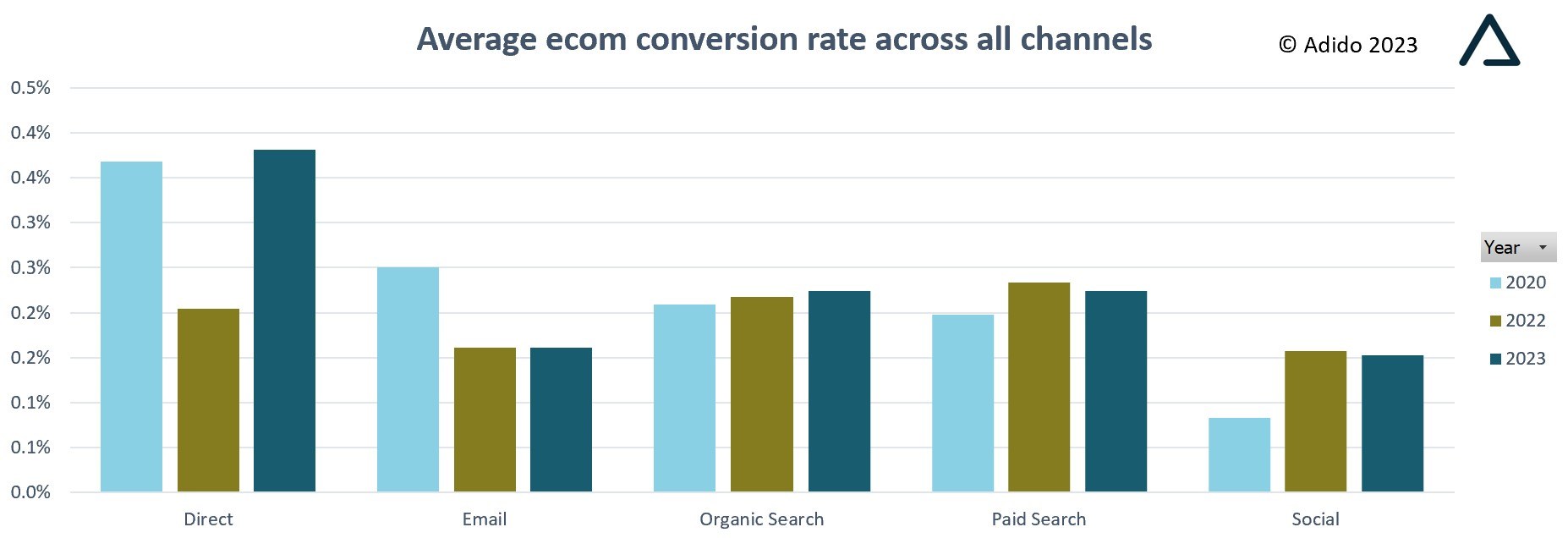

Finally, we wanted to highlight the effectiveness of each digital marketing channel - where are the best places to set your budget for success in 2023? As with anything, it really depends, but you can see the trends are what you'd expect, with direct and organic search converting the best on average. As mentioned above, these two channels are the most reliable in terms of stability and less prone to fluctuation/nuance.

Paid search continues to perform well, however, typically, and sadly, still includes brand bids as part of the overall PPC spend which can skew top level data greatly. One client saw over 80% of their PPC sales come from brand which represented less than 10% of their net pay per click spend. This meant that the remaining 90% of PPC budget produced less than 20% of their sales, not even generating enough revenue to cover the spend! Whilst there is hopefully some lifetime value to these customers, the first year profit figures will look dreadful, yet this level of detail is sadly rarely surfaced. The winners here ultimately are Google (again). You should be picking over your account in detail to find efficiencies and only spend where is it profitable to do so.

A summery summary?

Yes, we think so! The data looks good overall with a few places for optimism in 2023 with conversion rates and booking values staying strong and holding up well to 2019/2020 levels. As with our review of the Sunshine Saturday of 2023, there is cause for optimism this year within the travel sector. If you are running any paid media campaigns, then as long as they are managed well and monitored closely, there is room to get additional holiday bookings to keep pace with demand.

If you're planning on increasing your PPC or SEO spend this year, then there is good reason to think that this will pay back nicely, as long as you don't let Google run away with your budget or just go brand bidding in a quest to get cheap clicks and cannibalise your own traffic. Also consider doing remarketing campaigns if you've not run any for a while. The market for travel is here, and as shown below, conversion rates on brand should still be reasonably good. One particular travel brand ran a brilliant remarketing campaign, generating over 200 leads at a CPA of less than £2! Quality of these leads will need to be evaluated however, to get such volume as such a cheap cost per lead is fantastic to see and show the power of being really focussed on your audience with a strong message and website offering.

If you'd like to see more stats from our data or have any other comments, drop me a line!