Sunshine Saturday was touted as the busiest day of holiday bookings for years. But how did it perform against previous years?

The travel industry recently heralded 'Sunshine Saturday' as one of the biggest days for travel bookings of the year. And given the turmoil many travel businesses have faced this decade, many hoped it would be a bumper day for bookings both online and in store. Now that the dust has settled and the analytics numbers have all been ticked off online, I wanted to see how well our travel clients had done against previous years.

How strong is demand for travel online in 2023?

The general consensus in the travel industry seems to be that travel demand is back to pre-covid levels now, and in some instances actually surpassing those levels, which is fantastic news for both the industry and travellers alike. Most destinations have 'reopened', enabling travel agents to sell across the globe once more, as well as allowing travellers to visit those places that were completely off limits just a couple of years' back.

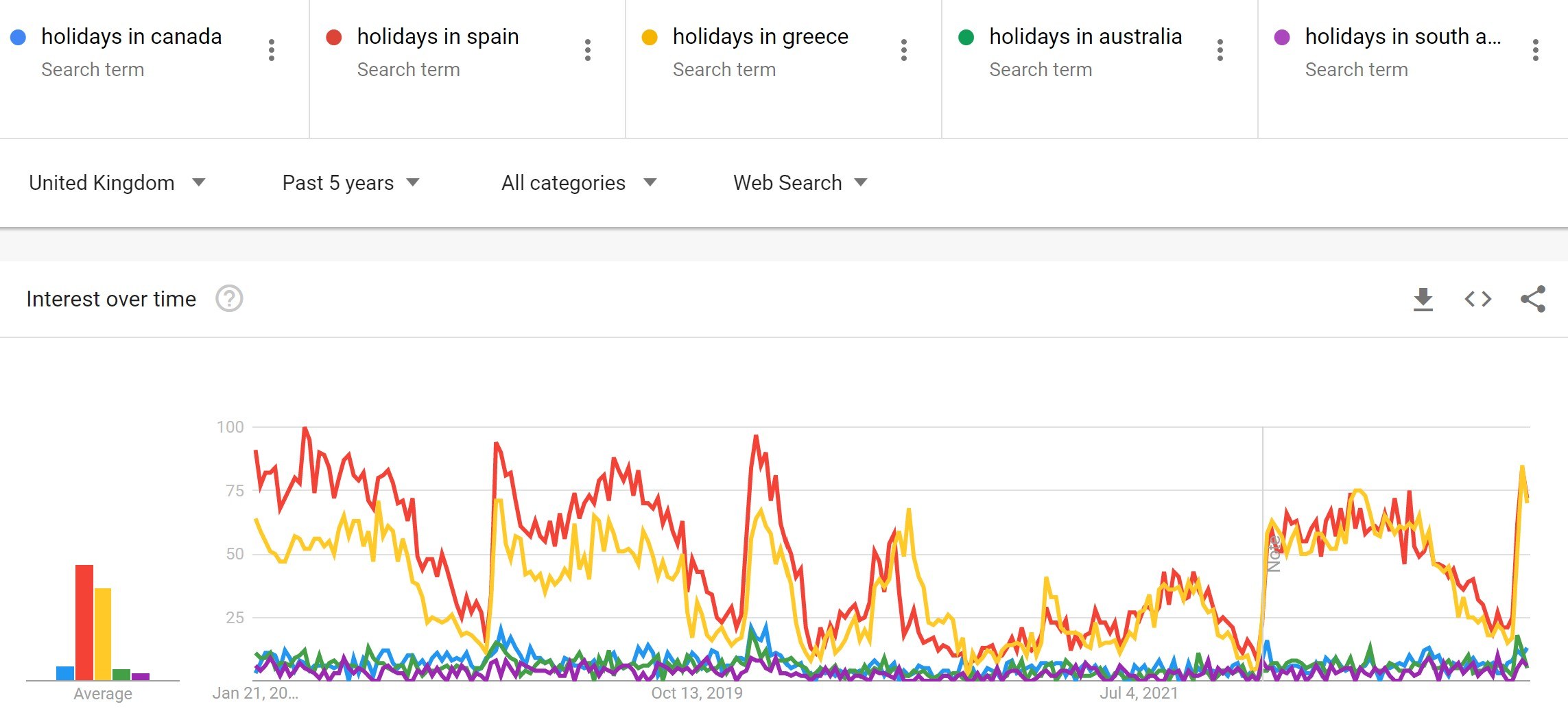

The stats online back this up. Looking at our dear friend Google Trends, volume and demand is back across many popular destinations as outlined below (I just picked a few countries below at random).

We can clearly see the booking peaks in the early months of each year. Demand also spikes again post lockdown in 2020, while 2021 proves to be a fairly flat year due to the numerous travel restrictions in place worldwide. 2022 saw a demand come back for a sustained period which has helped many travel businesses recover their losses and head into 2023 with renewed optimism.

2023 has started very strong too for a lot of travel brands, with record bookings predicted for some brands.

Sunshine Saturday 2023 versus 2022 and 2019 - how did we do?

First things first, every travel brand is different and have different markets they serve. Additionally, products have changed, as well as expectations from travellers, so doing anything truly like for like is always going to be hard. What we wanted to do is paint a picture using the data that we have available to try and outline what we see, hopefully for your benefit.

Secondly, the data we're presenting today is based off our Google Analytics data for the travel clients that we're engaged with. We know from working with them, that not all holidays are booked online, with many being done over the phone or in store. Therefore, capturing all booking data is incredibly hard and online sales represent a portion, albeit very large in some instances, of their total bookings.

Thirdly, Google Analytics data is only going to tell the story of the data it collects. Many Google Analytics accounts evolve over time and new goals or ecommerce features get added (or sometimes turned off!) as different marketing and IT people get involved. This has been exacerbated due to many changes in travel marketing teams in recent years as staff have left and then been rehired. That said, the data we're presenting here today has been taken from accounts where we've been able to compare like for like easily, with only a couple of exceptions.

Finally, to benchmark Sunshine Saturday in 2023, we looked at the first Saturday in 2022 which was a day later, and 2019, which was two days earlier. Would that make a difference to how and when people booked holidays? Probably not, but worth mentioning I think.

Anyway, that's the disclaimers out of the way, let's get to the good stuff!

Digging into website visits, bookings and conversions data

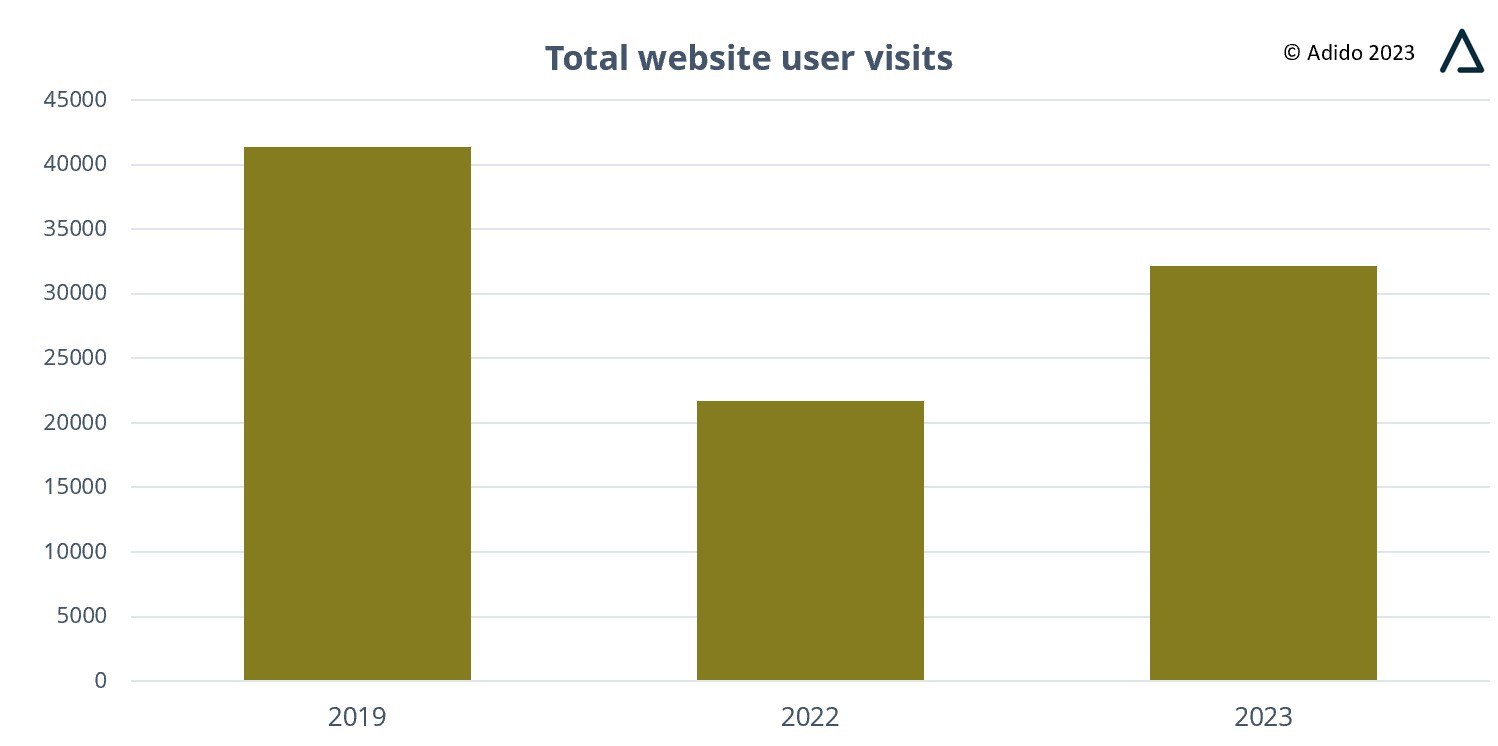

Overall, Sunshine Saturday 2023 was very good! We saw a variety of metrics keep pace with 2022 and in some places improve on them which was great to see. However, volume of sales on average was still down on 2019 although this was due to a variety of factors and skews in our data (i.e. some clients were spending more on PPC back in 2019 and haven't returned to the same levels).

First off - demand. Overall, traffic in 2023 was an improvement on 2022, but still down on 2019. Why? A number of reasons, but the main one from our perspective was confidence on behalf of our total client base. We say this because we know that some travel brands were spending 'normal' levels of marketing spend in 2019 based on many years of predictable behaviour. Still in 2023, despite a good 2022, there are clients who haven't wanted to, or been able to, spend as much as they have BC (before covid). Therefore, whilst numbers are up generally, there is still some way to go.

Whilst looking at the data, we realised that 'marketing noise' may actually be blurring the lines of what a baseline might be. Therefore, to get to a better view of overall demand, we decided to look at purely organic visits to the home page. We excluded 'direct' traffic as there are some clients who have set up Google Analytics accounts incorrectly, meaning direct traffic can be a variety of things, and subsequently false readings. Looking purely at organic traffic to the home page exclusively filters the traffic to those brands via search engines, which is a far more reliable number overall and takes out as much influence from outside factors as possible.

Rather than looking at pure numbers here, we felt it best to use 2019 as the benchmark and to then compare 2022 and 2023 against those numbers. The graph shows a very similar story to our total website visits graph in that 2019 is still the strongest year and that 2023 is up on 2022. By focussing just on brand traffic (by our definition) we hoped to see how much demand there was for consumers with the brands that they already know. The trend seems to follow the one identified that 2023 is good but not 2019 levels of good.

Summary

Whilst traffic is great, what we're really interested in (as I'm sure you are) is the commercials - did more visitors in 2023 lead to more holiday bookings and more revenue? The short answer seems to be yes.

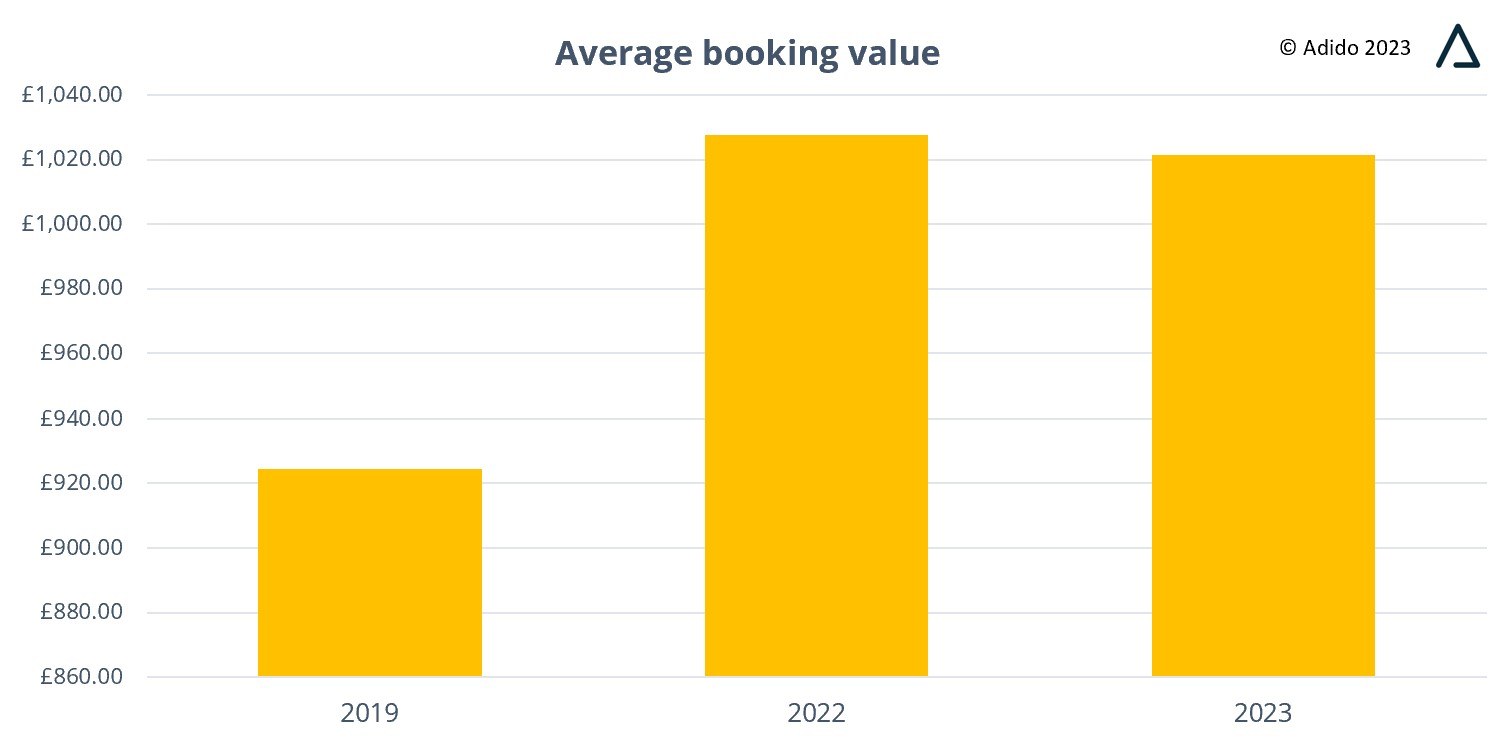

Average order within our client base stayed roughly the same as 2022 which was an increase of nearly 10% on 2019. So what? It would appear that those who are booking are still spending more than they did pre-covid, which is great to see. However, with inflation running around 10% in the UK and similarly high across Europe, we could also read that average holiday booking value is actually down roughly 10% against 2022, as in theory the cost increases travel businesses have seen should've been passed on to their travellers. Perhaps users are still very price sensitive and therefore, some travel brands haven't been able to - or wanted to - increase prices, keeping them at 2022 levels. If we're to plan ahead using last years averages for booking values, then I think that's a good move, rather than at 2019 levels.

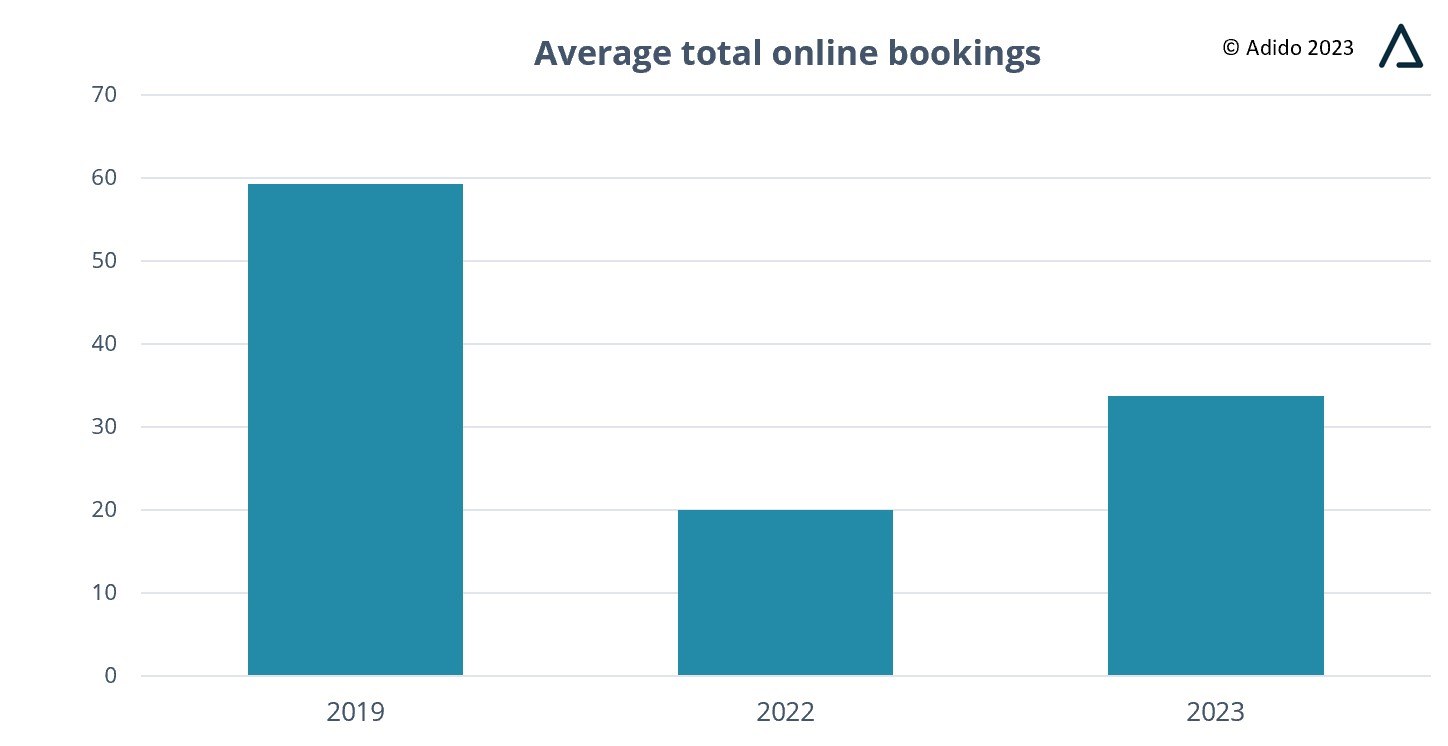

If booking values have held up to 2022, what about booking volumes? There is more good news here in that booking volumes across our clients actually increased in 2023.

Whilst numbers in our data set show that volume is still down on 2019, there has been a nearly 80% increase in online bookings this year versus last. This is great to see, as for most of our clients this indicates that demand is still strong and positive early predictions seem to have been born out! We'd expect this to be the case since users increased compared to 2022, but the conversion rates increased higher than the user growth, which again indicates a positive sign that those in market have been more willing to spend. As you can obviously see though, both years are not reaching the heights on 2019 which was a strong year, albeit at lower AOVs. The hope is that we will see a good year of stability in the travel market and that the volumes that some of our clients (and hopefully you reading this) have seen in the past do come back. And to reiterate, higher traffic in 2019, largely due to increased in ad spend, was partly behind this, so if we do see more confidence return, budgets increase and online ads pushed again, we'd like to see things increase further.

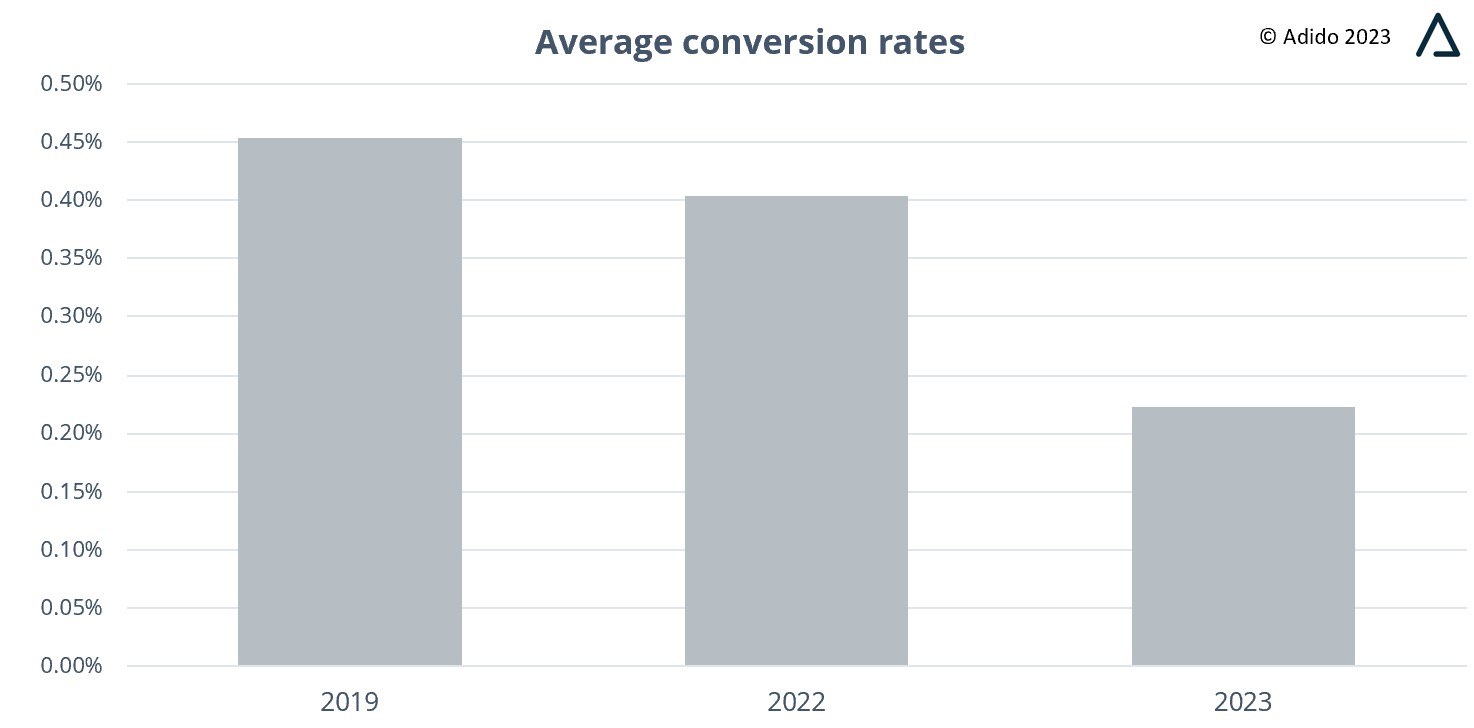

However, on the flip side, overall, despite increases in traffic and bookings, there are signs of potential weakness with online conversion rates decreasing on previous years, with a conversion rate decrease of nearly 50% compared to 2022.

So despite more bookings and good AOVs, there is still room for improvement. A weak conversion rate often means room for improvements online in the user journey, poor media targeting/management, a weak product offering or perhaps something else that might require looking into. We have to remember here that this is just a one day snapshot going under the microscope and it could be that more bookings happened offline after online research! That said, this is the only disappointing figure from our research and one that could be improved with some changes.

Does this mean 2023 will be great year for travel companies?

The signs do appear to be positive from our research.

Yes, it's only one day, and yes, our data set is limited to the clients that we work with so it's not necessarily representative of the whole market. However, we have a good variety of audiences included in our data and a wide range of clients which at least offers a broad view of how the market fared.

As we look towards the future, sentiment for travel is high and many travel businesses are making plans to take the good news of 2022 forwards into 2023 and beyond. Companies are hiring for travel marketing roles internally again and many budget lines are increasing to help boost website visits in the coming months. Whilst this is a great at an individual level with more focus going back into digital, it will mean that there will be more competition and as such costs are likely to go up. Things that might've been easy in 2022, might not be so this year and as always, those that have better data, insights and agility will tend to perform best. Investments into not only marketing but also data, CRM and tech will help those companies who want to get ahead, putting themselves in the best possible position to do so.

Should travel companies benchmark against 2022 or 2019?

This is a tricky one to answer. The data we've presented here would suggest that 2022 is the target on which to base this year's forecasts rather than 2019. In my personal opinion, there are too many factors that make 2019 a bad year to look back to. All of us have had to go through, and come out of, the covid lockdowns, which has no doubt changed all of us to varying degrees. When we travel, there will always be 'what if' concerns which may affect our booking patterns. There hasn't been a clear run for years for users to book 'normally'. A new norm needs to develop, but putting that on top of a mix of inflation, perhaps recession, war and many other things, means looking back only 12 months is the fairest measure in my opinion.

So far the signs, based off Sunshine Saturday data which we've picked through here, suggest that 2023 should still be a good year and will hopefully beat expectations.

If you've any comments or thoughts (or things you'd like to see or feel I've missed) please do let me know!