We’re now over three quarters of the way through 2025 and whilst there is talk of Google Search dying and travellers going to new destinations in favour of older ones, the data so far this year in Q1 and Q2 didn’t really show this.

So what about Q3? Did travellers search for new destinations? Were the peaks months peaking compared to previous years or was the late market not all it was cracked up to be? In our third part of our analysis this year, I’ve taken a deep dive into some of the destinations, continents and countries that saw more interest this summer, with some intriguing results.

Headlines

- Overall searches were down 1% in Q3 2025 compared to 2024 showing a slight slowdown in overall search activity perhaps reflecting the ‘difficult’ peaks period.

- For the big 10 destinations that UK travellers go to each year (as per ABTA Travel Trends) overall searches were also down by 19% year on year suggesting an overall lack of demand for the most popular destinations.

- As has been the case since the post-Covid years, cruise continues to be the standout performer, with demand up 14% in 2025 compared to 2024. Specialist interest holidays also saw strong growth, up 39%, while 18–30-style holidays rose by 21%, though both categories remain smaller overall.

- North America was the only continent to record an increase in searches, up 9% overall. This growth was almost entirely driven by cruise demand to the Caribbean, which surged by 300%, and interest in ‘Grand Canyon tours’, up 147%. While Google does occasionally reclassify search terms, which can cause notable spikes or drops, other Caribbean cruise searches were also generally up.

Top movers for Q3 2025 v Q3 2024

trinidad and tobago |

5400 |

5400 |

10800 |

100% |

guatemala |

4400 |

4700 |

7000 |

49% |

grenada |

10200 |

8700 |

12400 |

43% |

israel |

26800 |

16800 |

22800 |

36% |

el salvador |

3200 |

4380 |

5920 |

35% |

malta |

106700 |

139500 |

184000 |

32% |

bahamas |

130600 |

167650 |

211540 |

26% |

georgia |

6700 |

8200 |

10100 |

23% |

fiji |

51000 |

47700 |

58400 |

22% |

vanuatu |

21300 |

24300 |

29700 |

22% |

There are some notable jumps in our travel searches in Q3 in 2025 – the return of Isreal as a travel destination perhaps doesn’t come as much of a surprise given the ceasefire that was originally agreed in October 2025. Whether numbers get back to where they have been in the past remains to be seen considering the current perception of the Israeli government and the country’s political situation.

Other Caribbean destinations such as Trinidad, Grenada and Bahamas are on a continued increase, largely due to the continued growth of cruise in the region.

Top droppers for Q3 2025 v Q3 2024

czech republic |

17500 |

16800 |

11400 |

-32% |

albania |

109700 |

238500 |

156670 |

-34% |

new zealand |

101800 |

175800 |

115250 |

-34% |

zimbabwe |

6800 |

10200 |

6400 |

-37% |

turkey |

335970 |

302850 |

179230 |

-41% |

algeria |

5100 |

9600 |

5600 |

-42% |

bermuda |

34100 |

80800 |

36810 |

-54% |

peru |

33500 |

96830 |

38160 |

-61% |

Switzerland |

48150 |

123670 |

48710 |

-61% |

argentina |

27900 |

86100 |

31000 |

-64% |

It’s perhaps not surprising to see Argentina being fairly low down on the list given the country’s recent economic challenges. Whilst 2025 has seen a huge drop in their inflation rate, many are unaware of the incredible increases in prices that have been happening in recent years, forcing the price of many items to shoot up.

Other countries struggling with inflation such as Zimbabwe, Turkey and Switzerland have all seen drops in the last quarter too.

Continued cruise search growth

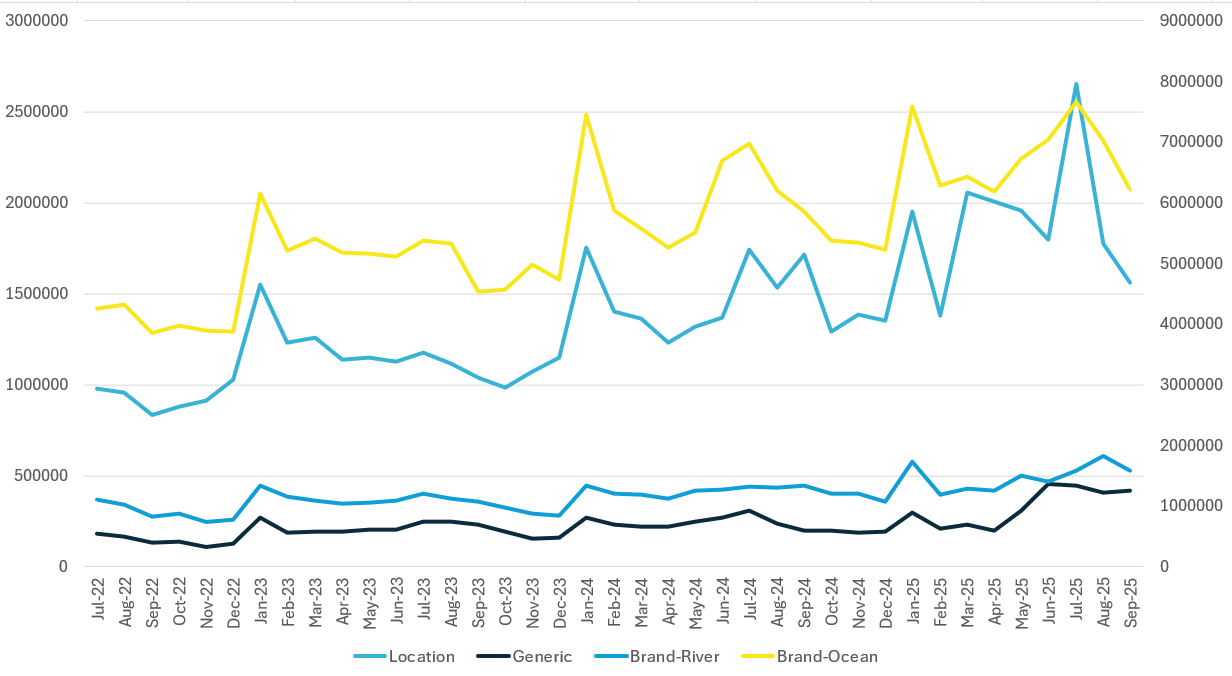

As I’ve mentioned above and in many other search travel trend updates in the last year, cruise is on a continued growth for searches overall. However, this last quarter has seen a fair shift in where travellers are looking for their cruises, with phrases like ‘norwegian cruise holidays’ and ‘mediterranean cruise’ both seeing significant drops, while other, warmer, locations such as the Caribbean are seeing a marked uptick.

River cruise line brand terms saw a sizeable 25% increase compared to last year, which may point to a growing preference for smaller ships over larger ocean liners, though ocean cruise searches were also up 8% year on year.

Final thoughts

It’s been a tricky quarter for the travel trade on Google, with searches down again for the second quarter in a row year on year. Overall searches on Google are down 2% for 2025 compared to 2024 which was up 5.4% on 2023. The post boom of travel is now definitely over and a new reality of search behaviour appears to be developing both in terms of the types of holidays that travellers are searching for but also where they are booking.

To further compound the search challenge, several studies show a general slowdown in clicks from search overall in 2025. With fewer travel searches taking place on Google and lower click-through rates, traffic is likely to become harder to secure in 2026. This means greater competition and higher costs for PPC, which should be factored into any 2026 planning or forecasting.

If you need help planning your PPC spend or some advice on how to counter the increases in PPC that you’re likely to experience, you know where we are!