With another year of searching and travelling behind us, we’ve spent some time digging into our ever-growing mountain of spreadsheets to pull out some key trends that may help guide thinking for 2026.

The 2025 headlines

I don’t need to tell you that 2025 brought plenty of change, both globally and within travel, and this year is shaping up to be just as eventful.

We have the FIFA World Cup to look forward to, the Winter Olympics are well under way and there are plenty of other huge sporting events on the horizon that'll have a big impact on when and where we travel. We also have ongoing wars, flat economies and new technologies, all of which continue to shape our travel choices and ways to find our next trip.

To give some context for the year overall, here are the main things to know:

Overall searches across our 1000+ search index were DOWN by 2% compared with 2024’s highest total of the decade. This is perhaps unsurprising given the wider backdrop, but it still raises the question of why. If global Google search volumes continue to rise, 2025 may simply have been an unusually event-heavy year that prevented travel demand from surpassing 2024’s record.

I expect booking numbers and destination patterns in 2026 will look largely similar to 2025 which I also predicted would struggle to reach the heights of 2024. This isn’t a doomy outlook, at least, I don’t want it to be. But we have to be realistic that the money in a lot of travellers’ pockets is the same or slightly less than last year when inflation is still higher than the economists want.

There is another possibility here which is that the traveller search journey happens less on Google now than at any other point in the last two decades. LLMs and social media are the mainstays of our time online, so we need to include these in our marketing mix to ensure we’re covering all the areas where our relevant audiences are going to be.

The biggest travel category in 2025 was… walking holidays! This sits separately from adventure in our dataset and reflects a slightly different type of trip. In 2025, traffic for walking holidays in the UK and Europe rose by 24% compared with 2024, a strong result that again suggests the typical walker has both the time and financial freedom to travel more often.

Close behind, the cruise sector saw search demand increase by 15%, a significant rise given that total annual cruise-related searches passed one billion for the first time in 2025.

Some areas did see a significant drop in searches, notably package holidays, specialist travel and solo travel, despite bookings in these categories reportedly increasing. There may be valid reasons for these year-on-year declines, but several of these areas also saw strong growth in 2024. Looking at the longer-term trend, the overall market therefore appears relatively stable.

Counties that won and lost search in 2025

Overall searches for specific countries dropped by 6% in 2025 compared to 2024. This is greater than the overall drop, implying travellers were more inclined to search for specific brands or types of travel than for the places they were looking to go. More interestingly, the locations with the largest year-on-year increases were long-haul destinations, with Tunisia, Ecuador and Mexico all recording search growth of 25% or more.

Other long-haul destinations such as Oman, Jordan and Sri Lanka have returned to travellers’ minds after several years of conflict and turmoil, again showing that news and regional affairs can play a role in driving or reducing demand.

Country | 2023 | 2024 | 2025 | 2025v2024 |

tunisia | 208700 | 270400 | 349800 | 29% |

ecuador | 156000 | 210500 | 263300 | 25% |

mexico | 733430 | 708240 | 884920 | 25% |

seychelles | 186500 | 208900 | 246100 | 18% |

taiwan | 126000 | 129200 | 148100 | 15% |

malta | 409700 | 567700 | 647800 | 14% |

oman | 99400 | 112700 | 128100 | 14% |

costa rica | 213750 | 201210 | 228600 | 14% |

jordan | 86100 | 64400 | 72700 | 13% |

sri lanka | 184800 | 245900 | 276400 | 12% |

Global politics will always play a role in what makes a destination feel desirable. It is therefore not surprising that, as shown in the table below, Argentina recorded the steepest drop in searches last year after a significant spike previously.

While some destinations have experienced short-term surges in recent years, historically popular countries such as Turkey, Croatia and Norway, along with more recent favourites like Albania, have also seen sustained post-Covid declines.

For those selling into these markets, it is worth monitoring performance throughout the year to see whether demand begins to recover.

Note: the countries included here each receive more than 50,000 Google searches annually in the UK, helping filter out smaller movements in lower-volume destinations.

|

Country |

2023 |

2024 |

2025 |

2025v2024 |

|

argentina |

125900 |

296200 |

127800 |

-57% |

|

peru |

135440 |

268860 |

153160 |

-43% |

|

Switzerland |

206420 |

311390 |

194380 |

-38% |

|

turkey |

1097470 |

1074390 |

705650 |

-34% |

|

albania |

361300 |

679200 |

515820 |

-24% |

|

norway |

167200 |

175300 |

135800 |

-23% |

|

jamaica |

235200 |

262500 |

204700 |

-22% |

|

greece |

3071900 |

3214200 |

2522240 |

-22% |

|

chile |

72100 |

110300 |

86800 |

-21% |

|

cabo verde |

928000 |

941500 |

742500 |

-21% |

|

croatia |

610480 |

676990 |

536180 |

-21% |

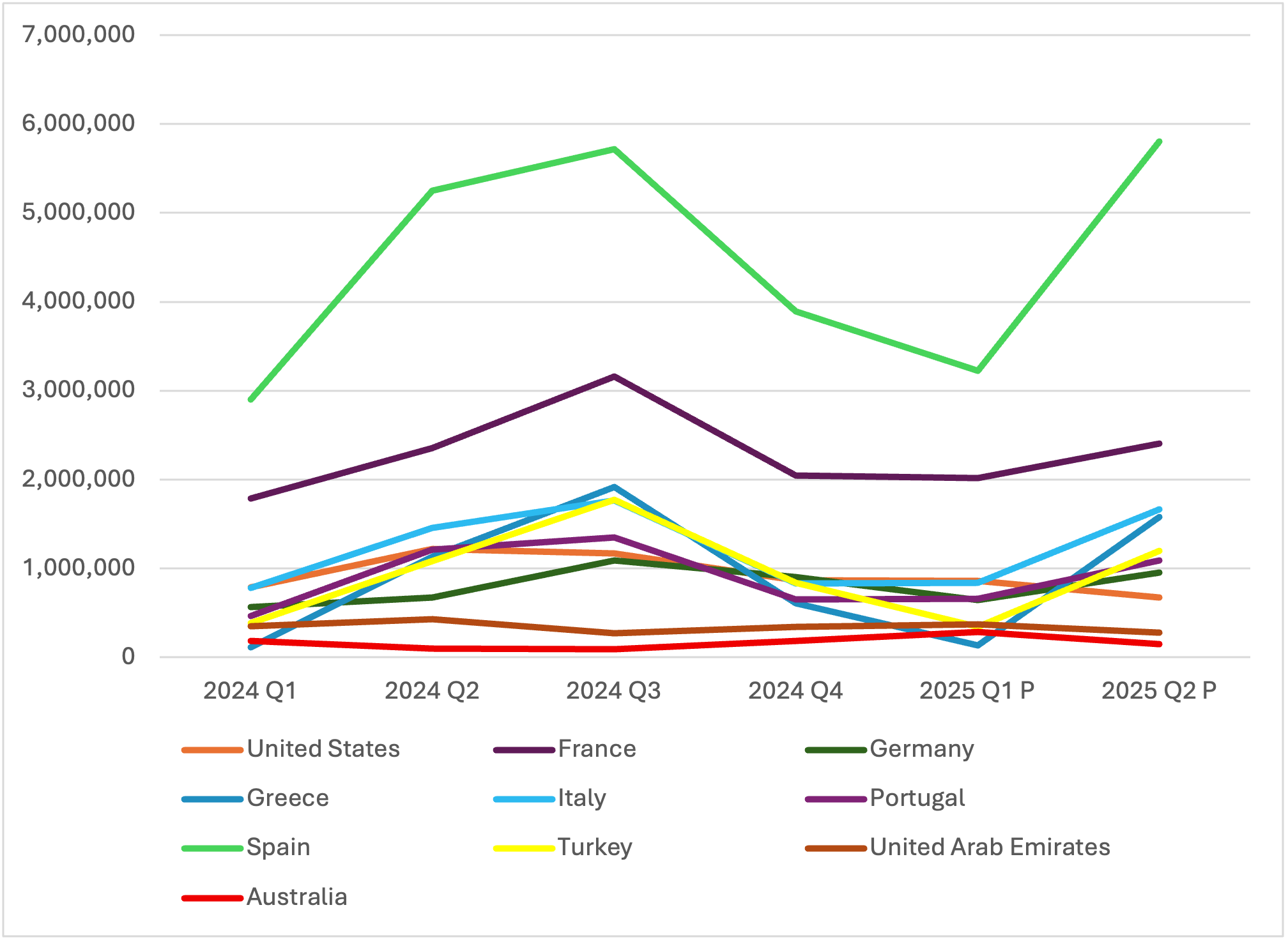

The top ten UK destinations

As the only dedicated ABTA Partner Plus marketing partner, we really enjoy reading through the many reports they produce each year looking into traveller and holiday habits. The top ten counties travellers in the UK visit each year doesn’t change a huge amount but we wanted to see this year how searches for the historically ‘big’ destinations had changed.

Of our top ten, only two saw increases, while some, as highlighted earlier, experienced big drops. The data below shows the searches sorted by percentage increase for the year.

|

Country |

2023 |

2024 |

2025 |

2025v2024 |

|

united arab emirates |

203900 |

177000 |

185300 |

5% |

|

portugal |

689380 |

713390 |

742140 |

4% |

|

italy |

3249580 |

3369190 |

3233460 |

-4% |

|

france |

897710 |

871060 |

828640 |

-5% |

|

usa |

5453880 |

7354650 |

6866200 |

-7% |

|

australia |

373180 |

471330 |

437830 |

-7% |

|

germany |

192760 |

212540 |

190480 |

-10% |

|

spain |

10290290 |

10376520 |

8871290 |

-15% |

|

greece |

3071900 |

3214200 |

2522240 |

-22% |

|

turkey |

1097470 |

1074390 |

705650 |

-34% |

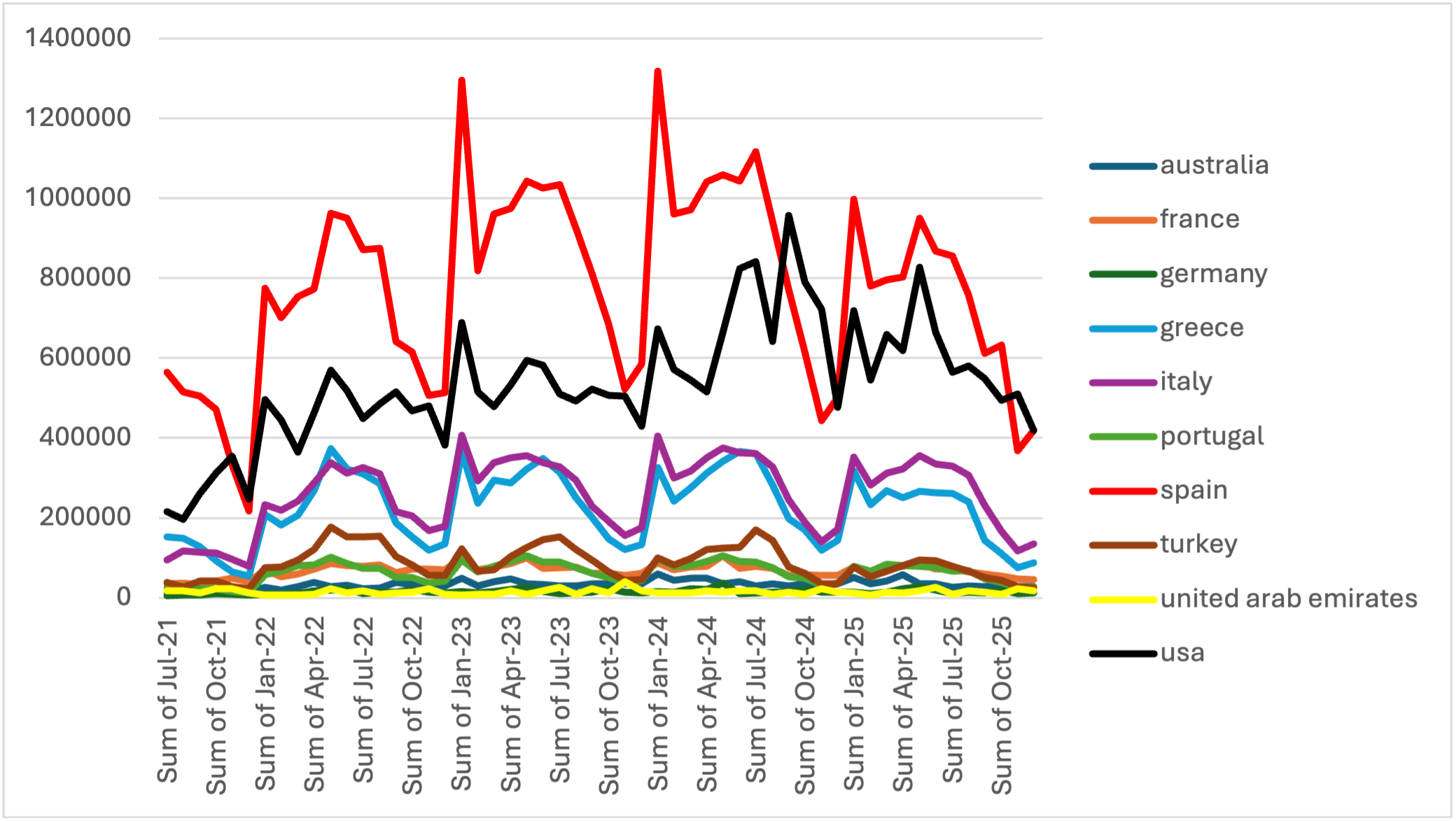

The graph below charts the top ten countries over the past four years by month, highlighting seasonal peaks along with summer demand and late-booking behaviour for each destination.

We know there are clear differences between when people search and when they travel, so we used ONS data to show where travellers have gone over the past two years. With data currently only available for 2024, this allows us to compare actual travel behaviour with our search trends.

Was there a Tr*mp slump in 2025?

Whilst much was made of inbound tourism to the US being in decline in 2025, both globally and from the UK, the headlines may have overstated the trend. Searches were down just 7% year on year, a smaller drop than many expected.

Whether this was offset by increased travel to the US in 2026, driven by the World Cup and Olympics, remains unclear. However, visitor spending in the US did fall, making it the only country to record a decline in 2025. For agents and operators selling the US market, conditions may remain challenging for the foreseeable future.

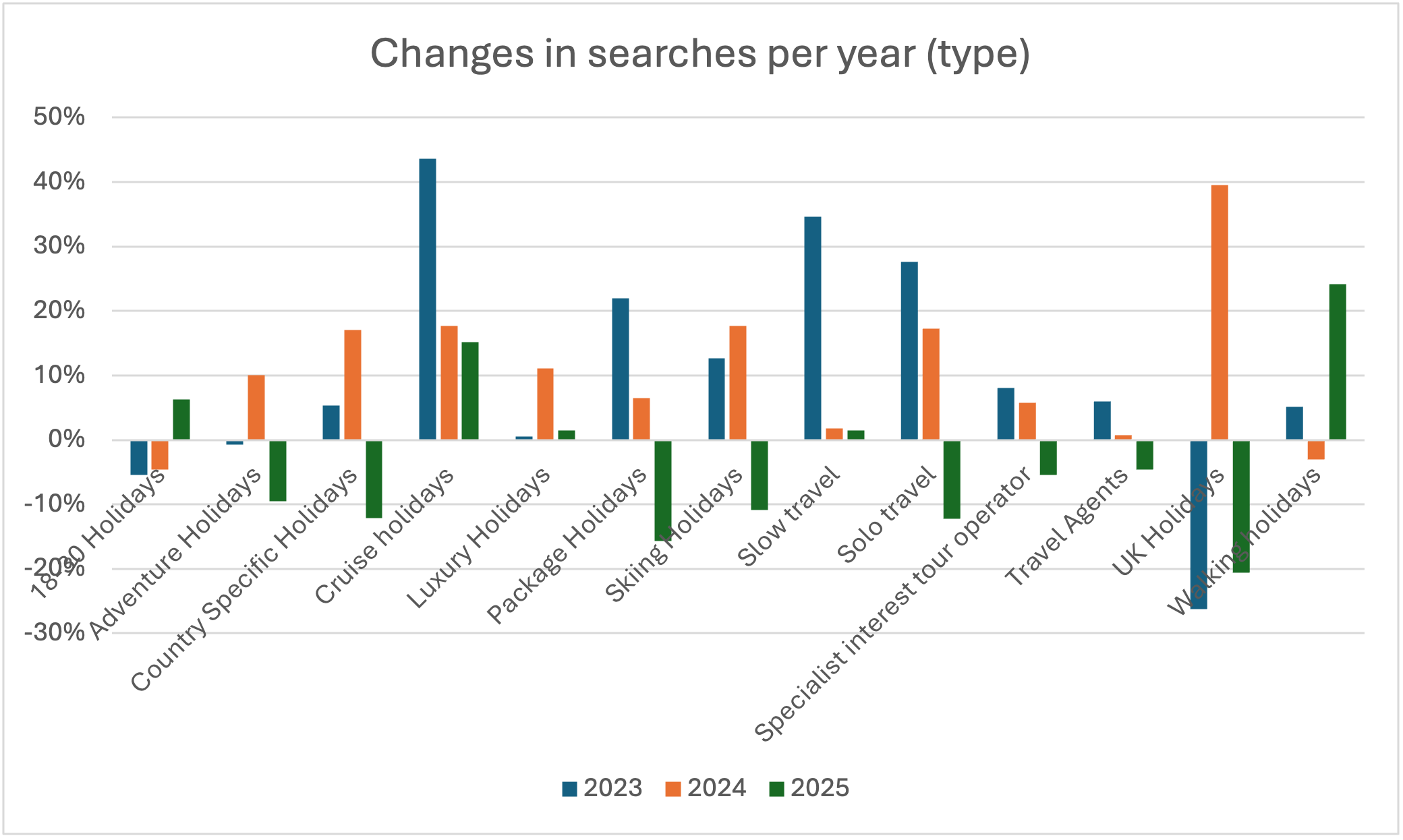

Holiday types

As well as looking at the countries travellers are searching for, we also analyse the types of holidays attracting interest. With more than 1,000 search types in our dataset, categorisation requires meticulous work, but years of historical data and validation give us confidence that the insights reflect the kinds of trips people genuinely want to take.

Perhaps surprisingly, the biggest growth of types of holiday for 2025 was walking holidays followed closely by the irrepressible cruise industry which for the third year in a row grew by more than double digits. These two and holidays for 18–30-year-olds were the only travel categories where we saw growth in 2025, with all other holiday types seeing stagnation or decline such as adventure skiing, adventure and special interest.

Given that older travellers often have greater disposable income and time to travel, the success of trip types traditionally associated with this group is unsurprising. Some of the recent declines in adventure and specialist interest travel may, however, recover in 2026 as travellers look for greater variety and external conditions continue to shift.

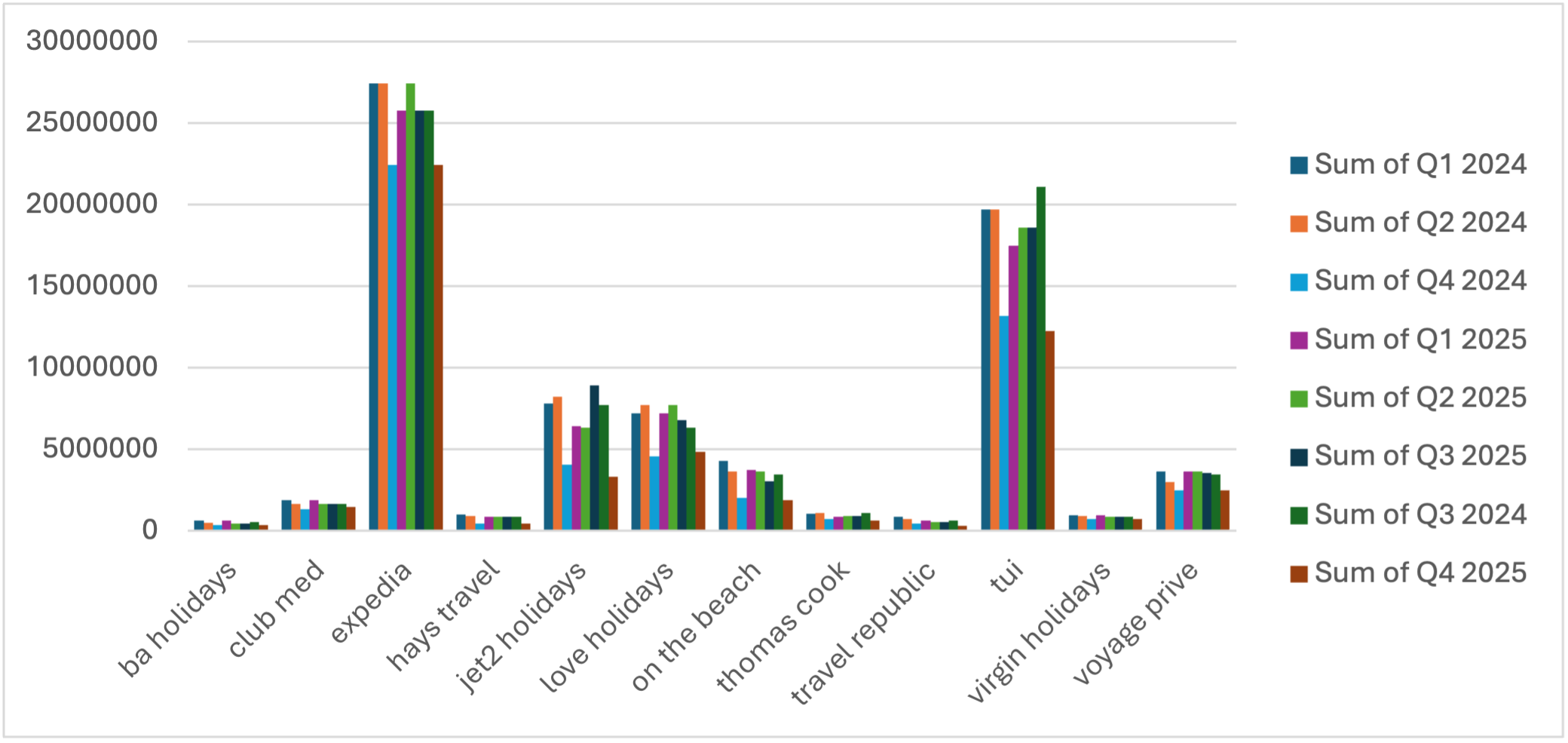

Package brands

Our friends at Travel Trade Consultancy ran some great Travelcasts in 2025 and I was lucky enough to appear on one of them! (Stay tuned for a 2026 guest appearance at some point, I hope!) Of all the many interesting data points they have shown over recent times, the concentration of ATOL licenses by the bigger OTAs and travel brands has grown dramatically through and post covid. UK travellers are increasingly going back to the bigger names again and again - perhaps reflecting the strength of their digital marketing as much as the budgets and collective buying power available to travellers, which continue to grow.

Over the last two years, searches for some of the bigger agents shown in our chart have stayed largely flat – again highlighting the increased efficiency in which bigger brands are able to retain clients directly without them having to search in the first place.

Summary

In the four years of putting these reports together, this is the first time that we’ve seen drops in our travel search data, which poses some interesting questions for 2026. Will this trend continue? Will it become even harder to win business from Google when searches are on a small decline overall and more pronounced in some places where geopolitics and other factors play? Or have travellers moved to other platforms when seeking out inspiration, ideas and recommendations on places to visit?

Perhaps all or maybe just some of these things are true. What is certain is that travellers are still keen as ever to travel in 2026 with more people intending to travel than ever before.

For travel brands and marketers, the clearer we can make our proposition, the better we do our promotion, improve our product and work on price then the better our chances of success. Just as I wrote about in my book.